PAN Card for NRO Account: Why It's Essential and How to Apply

PAN Card for NRO Account: A Quick Guide A PAN (Permanent Account Number) card is mandatory for Non-Resident Indians (NRIs) who wish to open an NRO (Non-Resident Ordinary) account in India. An NRO account is used to manage income earned in India, such as rent, dividends, or pensions, while you live abroad. Having a PAN card ensures compliance with Indian tax regulations and prevents higher Tax Deducted at Source (TDS) rates on income. NRIs can apply for a PAN card using Form 49AA through UTIITSL or NSDL portals. Required documents include a passport (identity proof), overseas address proof, and a passport-sized photo. The process is simple, and it takes around 15-30 days to receive your PAN card.

A PAN (Permanent Account Number) card is a critical document for Non-Resident Indians (NRIs) looking to open an NRO (Non-Resident Ordinary) account in India. An NRO account allows NRIs to manage their income earned in India, such as rent, dividends, pensions, or other income sources, while they reside abroad. However, to open an NRO account, a PAN card is mandatory as per Indian regulations.

In this article, we’ll explain why you need a PAN card for an NRO account, how to apply, and what documents are required.

Why NRIs Need a PAN Card for NRO Account

An NRO account enables NRIs to manage their income from India while adhering to Indian tax regulations. A PAN card is essential for the following reasons:

- Tax Deduction: The Indian government mandates Tax Deducted at Source (TDS) on the income credited to your NRO account. A PAN card ensures TDS is deducted at the correct rate, preventing excess tax deductions.

- Banking Compliance: Indian banks require NRIs to furnish their PAN card to open an NRO account.

- Financial Transactions: A PAN card is required for any significant financial transaction in India, including managing NRO account funds.

How to Apply for a PAN Card for NRO Account

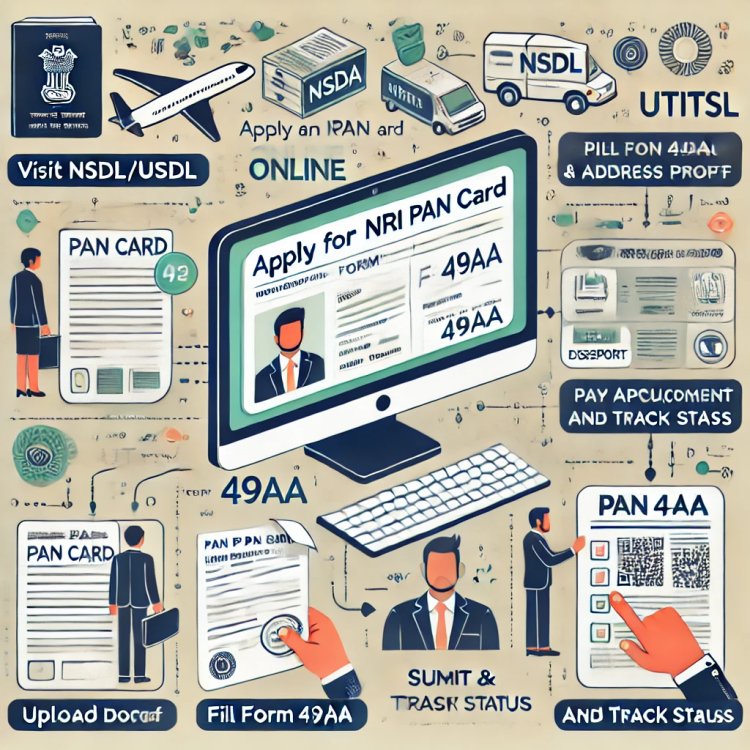

If you don’t already have a PAN card, you can easily apply for one online. NRIs must fill out Form 49AA, which is meant for individuals residing outside India. Here’s a step-by-step guide:

- Visit UTIITSL or NSDL Portal: NRIs can apply for a PAN card online through these portals.

- Complete Form 49AA: This form is specifically for NRIs and foreign nationals.

- Submit Required Documents:

- Identity Proof: Valid passport.

- Address Proof: Overseas address proof such as bank statements, utility bills, or an NRO account statement.

- Recent passport-size photograph.

- Pay the Fee: The fee varies based on whether your communication address is in India or overseas, with higher fees for international shipping.

- Receive and Track Your PAN Card: Once the application is submitted, you will receive an acknowledgment number to track the status of your PAN card.

Documents Required for PAN Card Application

- Passport: As identity proof for NRIs.

- Overseas Address Proof: This could be a bank statement, utility bill, or foreign residential proof.

- Passport-size Photograph: Recent photo.

Cost of Applying for a PAN Card

The cost of applying for a PAN card is higher if you reside outside India due to international shipping charges. The typical fee ranges from INR 1,020 to INR 1,070 for foreign addresses.

Benefits of PAN Card for NRO Account Holders

- Correct TDS Deductions: Ensures proper tax rates are applied on income earned in India.

- Banking and Investments: Required to open and operate an NRO account and engage in any financial transactions.

- Tax Filing: Necessary for filing income tax returns in India.

Conclusion

For NRIs, having a PAN card is essential for opening and managing an NRO account. It ensures compliance with Indian tax laws and helps you efficiently handle your income from India. The application process is simple, and applying for a PAN card using Form 49AA online ensures you can manage your finances seamlessly.

If you want to apply NRI PAN card, apply through this link https://idserve.in/

What's Your Reaction?