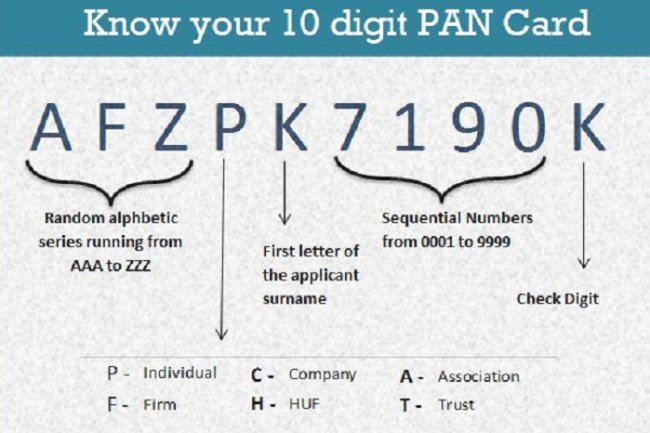

A Step-by-Step Guide to Online PAN Application for NRIs

Online PAN Application for NRIs – Quick and Easy Guide Non-Resident Indians (NRIs) can now easily apply for a PAN card online, which is essential for tax filing, investing, and conducting financial transactions in India. NRIs can apply through authorized platforms such as NSDL or UTIITSL. The application requires filling out Form 49AA and submitting documents like a passport copy (proof of identity) and an overseas bank statement or utility bill (proof of address). After submitting the form and paying the applicable fee (around ₹1,071 for foreign addresses), the acknowledgment receipt needs to be printed and sent along with attested documents to the processing center. The process allows NRIs to track their application status online and receive an e-PAN, which is valid for financial purposes. This online method simplifies the process, ensuring NRIs can obtain their PAN card without visiting India.

Introduction:

As a Non-Resident Indian (NRI), obtaining a Permanent Account Number (PAN) card is essential for conducting financial transactions in India. Whether you’re investing in mutual funds, purchasing property, or filing tax returns, a PAN card is a must-have. The good news is that NRIs can now apply for their PAN cards online, making the process more convenient and accessible. In this article, we’ll walk you through the steps for an online PAN application for NRIs.

Why NRIs Need a PAN Card: A PAN card is necessary for NRIs for various reasons:

- Tax Filing: If you have taxable income in India, a PAN is mandatory for filing income tax returns.

- Financial Investments: NRIs investing in Indian mutual funds, stocks, or properties need a PAN card.

- Bank Transactions: Opening a bank account or conducting transactions above ₹50,000 requires a PAN.

- Property Purchase: PAN is needed when buying or selling real estate in India.

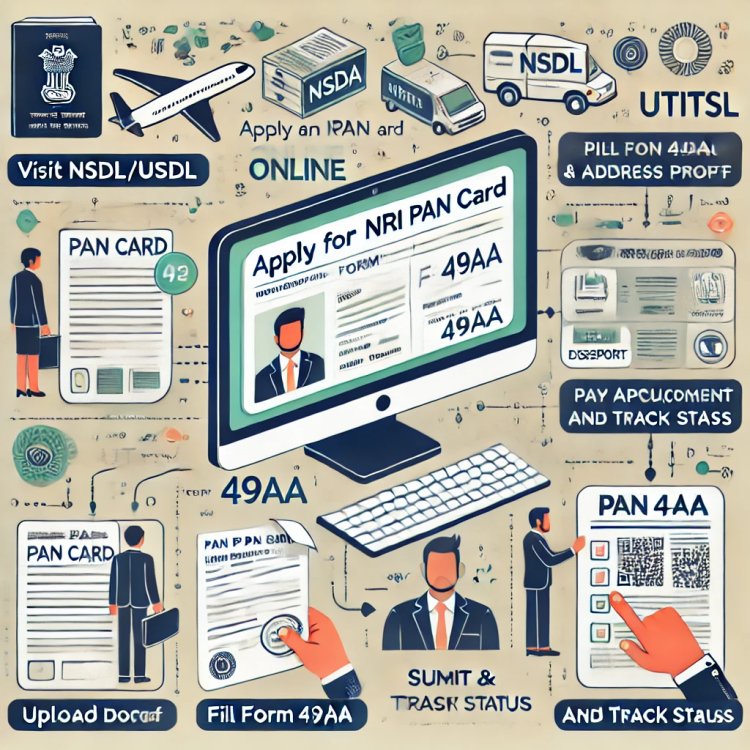

How to Apply for PAN Online for NRIs:

-

Choose the Right Service Provider: You can apply for a PAN card online through two authorized platforms:

- NSDL e-Governance (https://www.tin-nsdl.com/)

- UTIITSL (https://www.pan.utiitsl.com/)

-

Select the Correct Form: For NRIs, Form 49AA is applicable. Make sure to select the form intended for Indian citizens residing abroad.

-

Fill in Personal Details: Enter your personal details such as full name, date of birth, address, and contact information. Be sure to select your overseas address as the communication address if you’re currently living outside India.

-

Submit Required Documents: NRIs need to provide:

- Proof of Identity (POI): Passport copy.

- Proof of Address (POA): Overseas bank statement, utility bill, or passport.

- Passport-sized photographs: Two recent color photographs.

For documents, ensure that all copies are attested either by the Indian embassy or by a notary in the country of residence.

-

Pay the Application Fee: The fee for NRIs varies based on the communication address. For addresses outside India, the fee is generally ₹1,071, and for Indian addresses, it’s ₹93. Payments can be made via credit/debit cards, net banking, or demand draft.

-

Submit the Application: After filling out the form and uploading the required documents, submit your application online. Print the acknowledgment receipt and send it along with the documents to the designated PAN processing center.

-

Track Your Application Status: Use the acknowledgment number provided after submission to track your PAN application online. The card will be sent to your registered address, and you can also download an e-PAN once it’s issued.

Frequently Asked Questions:

-

Can NRIs apply for PAN without visiting India? Yes, the entire process can be completed online, and the physical documents can be couriered from abroad.

-

What is an e-PAN? An e-PAN is an electronically issued PAN card in a digital format, which holds the same value as the physical card and can be downloaded online.

-

How long does it take to receive a PAN card? Typically, it takes about 15-20 working days to receive your PAN card after the submission of documents.

Conclusion: Applying for a PAN card as an NRI is now more convenient with the online process. By following the steps mentioned above, you can easily obtain your PAN card without needing to visit India. Having a PAN is essential for managing your financial activities in India, so if you’re an NRI without one, apply for it online today.

If you want to apply NRI PAN card, apply through this link https://idserve.in/

What's Your Reaction?