PAN Card for NRI Account: Why It's Essential and How to Apply

PAN Card for NRI Account: Why It's Essential A PAN (Permanent Account Number) card is crucial for NRIs (Non-Resident Indians) who wish to open and operate NRI accounts like NRE, NRO, or FCNR in India. It is required for financial activities such as filing income tax, investing in stocks and mutual funds, and avoiding higher TDS (Tax Deducted at Source) on income earned in India. NRIs can apply for a PAN card by filling out Form 49AA and submitting identity and address proof (passport, OCI card). Applications can be made online through NSDL or UTIITSL portals, and the PAN card is usually delivered within 15-30 days.

Non-Resident Indians (NRIs) often need a PAN (Permanent Account Number) card when managing financial transactions in India, including opening and maintaining an NRI account. A PAN card serves as a unique identifier for individuals and helps track financial activities, making it a crucial document for NRIs who wish to invest, file taxes, or engage in banking activities in India. This article explains the importance of a PAN card for NRI accounts and provides a detailed guide on how to apply.

Why NRIs Need a PAN Card for NRI Accounts

If you are an NRI and wish to open or operate any type of NRI bank account (NRE, NRO, or FCNR), a PAN card is often required. Here are the primary reasons why NRIs need a PAN card for their NRI accounts:

- Tax Compliance: A PAN card is necessary for filing income tax returns in India if you earn taxable income through Indian investments or assets.

- Investment Purposes: A PAN card is essential for investing in mutual funds, stocks, or fixed deposits in India.

- Banking Operations: Many Indian banks require NRIs to provide their PAN card while opening or maintaining NRI accounts (NRE/NRO/FCNR accounts).

- Preventing TDS Deductions: NRIs without a PAN card may face higher rates of Tax Deducted at Source (TDS) on their income in India, including interest earned from NRO accounts.

Types of NRI Accounts Requiring a PAN Card

NRIs typically open the following types of accounts in India:

- NRE (Non-Resident External) Account: This is a savings or fixed deposit account where NRIs can deposit foreign earnings, and the principal and interest are fully repatriable.

- NRO (Non-Resident Ordinary) Account: This account is used to manage income earned in India, such as rent or dividends. The interest earned is subject to tax in India.

- FCNR (Foreign Currency Non-Resident) Account: This account allows NRIs to save money in foreign currency, with no exposure to exchange rate fluctuations.

Having a PAN card simplifies the process of opening these accounts and managing financial activities in India.

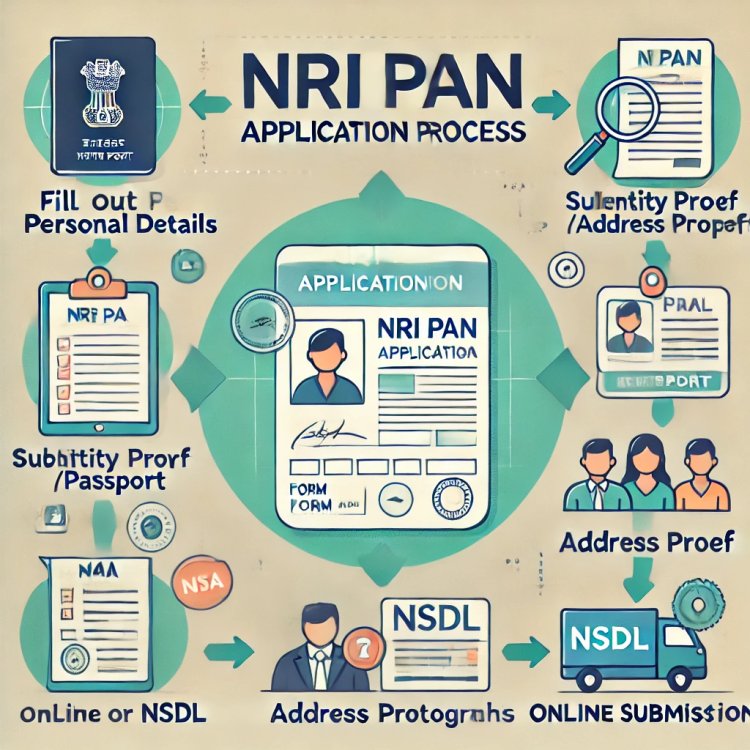

How to Apply for a PAN Card as an NRI

The process for NRIs to apply for a PAN card is straightforward and can be done online or offline. NRIs should fill out Form 49AA, which is designated for foreign citizens and NRIs.

Step-by-Step Guide to Apply for a PAN Card for NRI Accounts:

-

Access the Application Portal

- NRIs can apply for a PAN card through the official portals of either NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology and Services Limited).

-

Select Form 49AA

- Form 49AA is specifically designed for foreign citizens, including NRIs, to apply for a PAN card.

-

Provide Personal Details

- Enter your full name, date of birth, contact details, and foreign or Indian address. Make sure the details match your identity documents.

-

Submit Supporting Documents

- NRIs need to submit proof of identity (OCI card, passport, etc.) and proof of address (foreign or Indian). A passport is typically used as a primary document for NRIs.

-

Pay the Application Fee

- There is a nominal fee for the PAN card application. The fee varies depending on whether the PAN card is to be sent within India or to a foreign address. Payment can be made online.

-

Submit the Application

- Once the form is completed and the documents are submitted, you will receive an acknowledgment number that can be used to track the status of your application.

-

Receive PAN Card

- The PAN card is usually processed and delivered within 15-20 business days. For NRIs residing abroad, the PAN card can be delivered to a foreign address or an Indian address, based on preference.

Common Mistakes to Avoid While Applying for a PAN Card

- Ensure that all information matches the details in your identity documents.

- Double-check the required documents for accuracy and clarity before submitting them.

- Be sure to enter a valid email address and phone number for updates and communication.

Conclusion

For NRIs, having a PAN card is essential for managing financial transactions in India, including operating NRI accounts, making investments, and filing taxes. By following the simple process of applying for a PAN card through Form 49AA, NRIs can ensure smoother and more efficient financial operations in India. With a PAN card, NRIs can also avoid higher tax deductions and stay compliant with India’s financial regulations.

If you want to apply NRI PAN card, apply through this link https://idserve.in/

What's Your Reaction?