NRI PAN – Importance and How to Apply

NRI PAN Card – How to Apply A PAN (Permanent Account Number) card is essential for Non-Resident Indians (NRIs) who engage in financial transactions in India. NRIs need a PAN card for tax filings, investing in Indian stocks or mutual funds, buying or selling property, and opening NRE/NRO bank accounts. To apply, NRIs can fill out Form 49A or 49AA, submit required documents like a passport, NRE bank statement, proof of address, and recent photographs. Documents must be attested by an Indian Embassy or Consulate. The PAN card will be issued within 15-20 days and sent to the applicant's foreign address.

A PAN (Permanent Account Number) is a mandatory document for Non-Resident Indians (NRIs) to conduct financial transactions in India. Whether you're looking to invest in Indian markets, buy property, or comply with tax obligations, having a PAN card is essential for NRIs. Here's an overview of its importance and how to apply for it.

Why NRIs Need a PAN Card

- Tax Filing: NRIs with taxable income in India need a PAN card to file income tax returns.

- Investment in Financial Instruments: A PAN card is mandatory for NRIs looking to invest in shares, mutual funds, and other securities in India.

- Real Estate Transactions: NRIs must provide a PAN card to buy or sell property in India.

- Opening Bank Accounts: A PAN card is needed for opening NRE (Non-Resident External) or NRO (Non-Resident Ordinary) accounts in India.

- Remittances: PAN card details may be required when making high-value remittances to India.

How to Apply for an NRI PAN Card

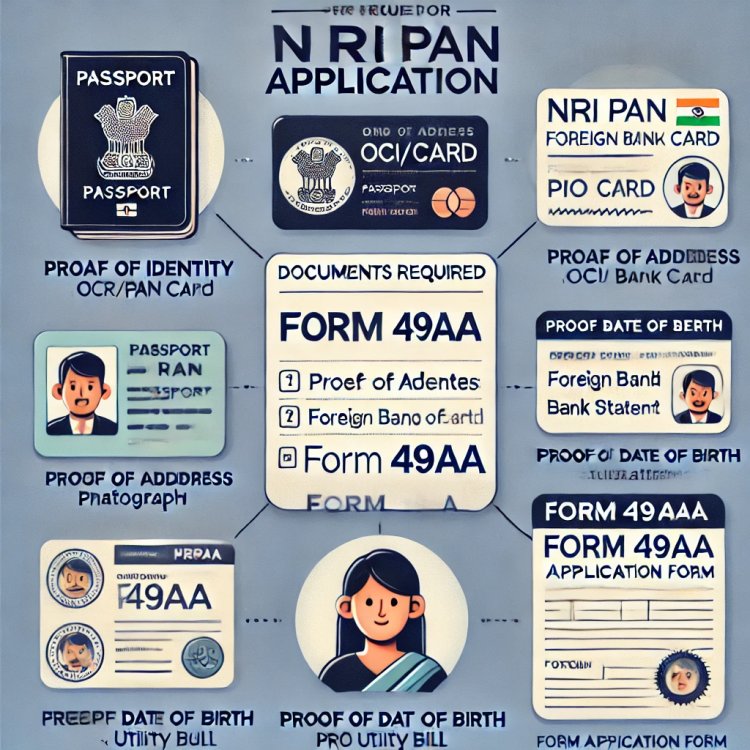

NRIs can apply for a PAN card using Form 49A or Form 49AA (for foreign nationals). The application process can be completed online or offline.

Steps to Apply:

- Fill out the Application Form:

- NRIs can submit either Form 49A (for Indian citizens) or Form 49AA (for foreign nationals).

- Submit Required Documents:

- Proof of Identity (POI): Passport, OCI/PIO card

- Proof of Address (POA): NRE bank statement, foreign bank statement, utility bill

- Proof of Date of Birth (DOB): Passport, birth certificate

- Two recent passport-sized photos

- Attestation of Documents:

- Documents must be attested by an Indian Embassy, Consulate, or a Notary in the applicant's country of residence.

- Make the Payment:

- Fees vary based on the country of residence and the mode of application.

- Receive the PAN Card:

- Once the application is processed, the PAN card will be dispatched to the NRI's foreign address.

Key Points:

- Ensure all documents are clear and attested.

- The process usually takes 15-20 days.

- NRIs should apply for a PAN card if they have any financial ties with India to avoid penalties or delays in transactions.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?