NRI PAN Card Services: Simplified Solutions for Global Indians

NRI PAN Card Services - Quick & Convenient Application NRI PAN card services offer an easy, online solution for Non-Resident Indians (NRIs) to apply for a PAN card, which is necessary for tax filing, property transactions, investments, and banking in India. With these services, NRIs can complete the process from anywhere in the world, using platforms like NSDL or UTIITSL. The service assists with form submission, document verification (such as passport and overseas address proof), real-time tracking, and customer support. Once approved, the PAN card is delivered to the applicant’s chosen address in India or abroad. Simplify your PAN card application with trusted NRI PAN card services today!

Introduction

A PAN (Permanent Account Number) card is essential for Non-Resident Indians (NRIs) who wish to carry out financial activities in India, such as investing, opening bank accounts, or purchasing property. With the rise of digital platforms, NRI PAN card services have become more accessible, offering seamless application and processing for NRIs living abroad. In this article, we will explore how these services simplify the application process, key benefits, and how NRIs can take advantage of them to apply for a PAN card effortlessly.

Why Do NRIs Need a PAN Card?

NRIs require a PAN card for several important reasons:

- Tax Filing: NRIs with taxable income in India must have a PAN card to file their income tax returns.

- Investments: It is mandatory to have a PAN card to invest in shares, mutual funds, or other financial products in India.

- Property Transactions: Purchasing or selling property in India requires a PAN card.

- Banking Needs: A PAN card is necessary for opening Non-Resident External (NRE) or Non-Resident Ordinary (NRO) bank accounts.

- Avoid Higher Tax Deductions: Without a PAN card, NRIs face higher Tax Deducted at Source (TDS) rates on income earned in India.

What Are NRI PAN Card Services?

NRI PAN card services offer a convenient way for NRIs to apply for and obtain their PAN card online. These services guide applicants through every step, from document submission to final card issuance, and ensure that the entire process is quick, transparent, and compliant with Indian tax laws.

Key Features of NRI PAN Card Services

-

Online Application Assistance

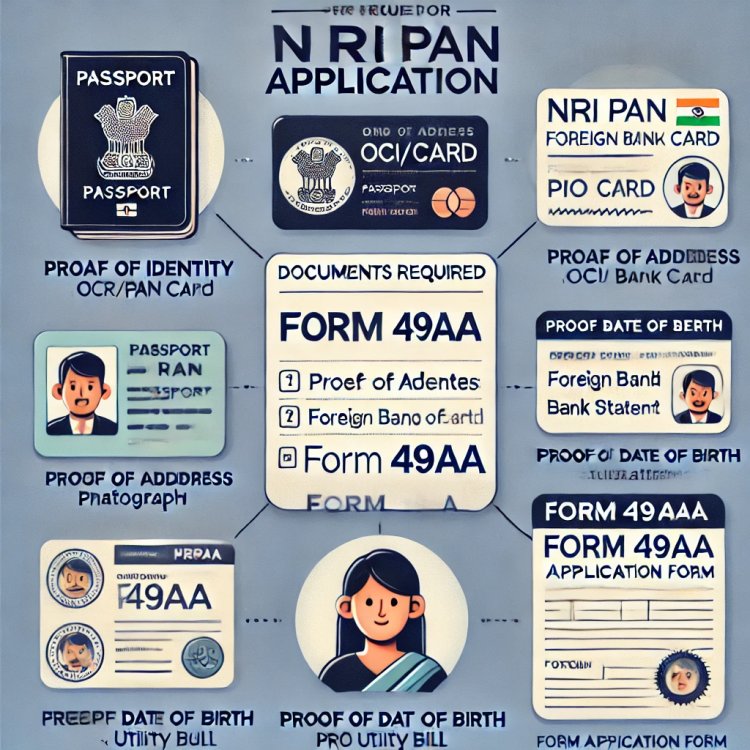

NRI PAN card services simplify the application by providing user-friendly online portals. Applicants can fill out the required Form 49AA and upload necessary documents directly from any location. -

Document Verification

Service providers help NRIs verify and upload the correct documents, ensuring smooth processing. The key documents required include a valid passport, overseas address proof, and passport-sized photographs. -

Tracking Application Status

With professional NRI PAN card services, applicants can track the status of their application in real-time, ensuring transparency at every stage. -

Timely PAN Card Delivery

After successful submission and verification, the PAN card is dispatched to the address provided—either in India or abroad—depending on the applicant’s preference. -

Customer Support

Many services offer dedicated customer support to answer queries, resolve issues, and provide guidance throughout the process.

How to Apply for an NRI PAN Card Online

- Choose a Reliable Service Provider: Several providers, including official platforms like NSDL and UTIITSL, offer NRI PAN card services.

- Fill out Form 49AA: NRIs must use this form, designed for non-residents.

- Upload Required Documents: Submit proof of identity, address, and recent photographs.

- Pay the Application Fee: Fees vary based on your address, with higher fees for overseas communication addresses.

- Track the Application: Use the service provider’s tracking tools to monitor the progress of your application.

Benefits of NRI PAN Card Services

- Convenience: No need to visit India; complete the process from anywhere.

- Faster Processing: The online submission and verification process accelerates PAN card issuance.

- Assured Compliance: Professional services ensure compliance with Indian tax laws and procedures.

- Seamless Experience: Applicants can navigate the application easily with step-by-step guidance.

- Cost-Effective: Avoiding higher TDS rates and completing tax formalities efficiently saves both time and money.

Conclusion

NRI PAN card services offer a seamless, hassle-free solution for Non-Resident Indians looking to manage their financial matters in India. By utilizing online platforms, NRIs can now easily apply for and receive their PAN card, ensuring they stay compliant with Indian tax laws while managing their investments and financial transactions efficiently. Take advantage of these services today to simplify your PAN card application process!

If you want to apply NRI PAN card, apply through this link https://idserve.in/

What's Your Reaction?