How to Apply for a PAN Card as an OCI – Complete Guide

PAN Card Application for OCI – Quick Guide Overseas Citizens of India (OCI) who need to conduct financial transactions in India, such as investing, filing taxes, or purchasing property, are required to have a PAN card. OCIs can apply for a PAN card online through authorized platforms like NSDL or UTIITSL using Form 49AA, which is meant for foreign nationals and non-resident individuals. Applicants must provide proof of identity (OCI card or passport), proof of overseas address (utility bill, bank statement, etc.), and two passport-sized photos. All documents need to be attested by the Indian embassy or a notary in the applicant’s country of residence. The application fee is ₹93 for Indian addresses and around ₹1,071 for foreign addresses, with payments accepted via credit/debit cards, net banking, or demand draft. After submission, the acknowledgment receipt and attested documents must be sent to the designated PAN processing center. OCI holders can also track their applicatio

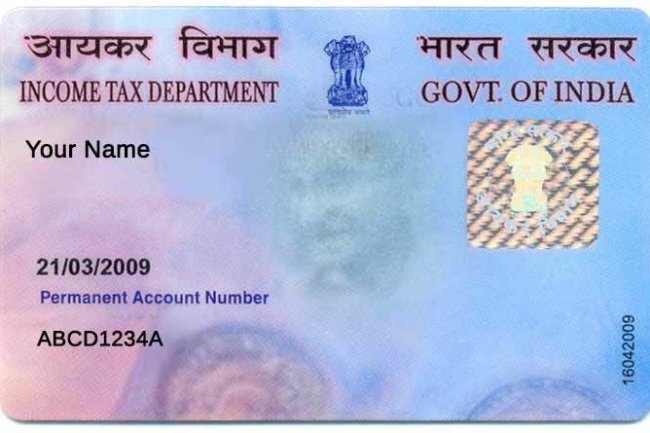

Introduction: Overseas Citizens of India (OCI) who engage in financial transactions in India need a PAN (Permanent Account Number) card. Whether it's for opening a bank account, investing in Indian mutual funds, or purchasing property, having a PAN card is essential. In this guide, we will walk you through the step-by-step process of applying for a PAN card as an OCI holder.

Why OCIs Need a PAN Card:

- Tax Filing: If you have taxable income in India, a PAN card is mandatory to file income tax returns.

- Investment Purposes: PAN is required for investing in Indian stocks, mutual funds, or real estate.

- Banking Needs: Opening a savings or NRO (Non-Resident Ordinary) account, and conducting transactions over ₹50,000 require a PAN card.

- Property Transactions: Buying or selling property in India requires a PAN for both legal and tax purposes.

Steps to Apply for PAN Card for OCI Holders:

-

Choose the Application Platform: You can apply for a PAN card through either:

- NSDL e-Governance portal (https://www.tin-nsdl.com/)

- UTIITSL portal (https://www.pan.utiitsl.com/)

-

Select the Correct Form (49AA): For OCI holders, the appropriate form for PAN card application is Form 49AA, which is for individuals not residing in India or foreign nationals, including OCIs.

-

Fill in the Details: Enter your personal information, such as your name, date of birth, and OCI details. Ensure that your communication address is updated and accurate, especially if you reside abroad.

-

Submit Documents: OCI holders need to provide the following documents:

- Proof of Identity (POI): Copy of your OCI card or passport.

- Proof of Address (POA): Overseas address proof such as a utility bill, bank statement, or government-issued document.

- Two passport-sized photographs.

All documents must be attested by a notary public or by the Indian embassy/consulate in your country of residence.

-

Pay the Application Fee: The fee varies depending on whether the communication address is in India or abroad. Typically, it is ₹93 for Indian addresses and around ₹1,071 for foreign addresses. Payment can be made online via credit/debit cards, net banking, or demand draft.

-

Send the Documents to the Processing Center: After completing the online application, print the acknowledgment receipt. Send it along with your supporting documents to the PAN processing center in India.

-

Track Application Status: You can track your PAN card application status using the acknowledgment number provided upon submission.

-

Receive the PAN Card: Once processed, the PAN card will be delivered to the address provided. OCI holders can also download an e-PAN, which is equally valid for financial transactions.

Common Mistakes to Avoid:

- Ensure all details entered are accurate and match the documents provided.

- Make sure that the documents are attested properly to avoid delays in processing.

- Double-check the payment method and ensure the correct amount is paid based on your address.

Conclusion: Obtaining a PAN card as an OCI holder is a straightforward process that can be completed online. Having a PAN card is crucial for managing your finances and fulfilling legal requirements for tax and investments in India. Follow the steps outlined above, and you’ll have your PAN card in no time.

If you want to apply NRI PAN card, apply through this link https://idserve.in/

What's Your Reaction?