Tag: #NSDLPAN

How to Perform a PAN Name Search: A Comprehensive ...

Introduction : The PAN (Permanent Account Number) is a unique identifier issued by the Income Tax Department of India to individu...

How to Check PAN Card Details Online: A Complete G...

Introduction : The PAN (Permanent Account Number) card is an essential identification document for Indian taxpayers. Whether you'...

How to Search by PAN Number to Find the Name Linke...

Introduction : The Permanent Account Number (PAN) is a crucial identification tool in India, used primarily for tax purposes but ...

How to Check PAN Card Details Using Your PAN Numbe...

Introduction : The Permanent Account Number (PAN) is a unique ten-character alphanumeric identifier issued by the Income Tax Depa...

How to Apply for a PAN Card Online: A Step-by-Step...

Introduction : The Permanent Account Number (PAN) is an essential identification number for Indian citizens, especially for those...

How to Apply for a PAN Card Online: A Complete Gui...

Introduction : A Permanent Account Number (PAN) is a vital identification number for all financial transactions in India. Whether...

Streamlining Your PAN Card Application Process

Introduction : In today’s digital age, accessing essential services online has become the norm. Among these crucial services is t...

NSDL PAN Card Apply: A Complete Guide

Introduction : Applying for a PAN card through NSDL (now Protean eGov Technologies) is a straightforward process that can be comp...

PAN Apply Online: Your Step-by-Step Guide

Introduction : Applying for a Permanent Account Number (PAN) has never been easier, thanks to the convenience of online applicati...

About PAN Card

Introduction : PAN (Permanent Account Number) is a unique, 10-character alphanumeric identifier issued by the Income Tax Departme...

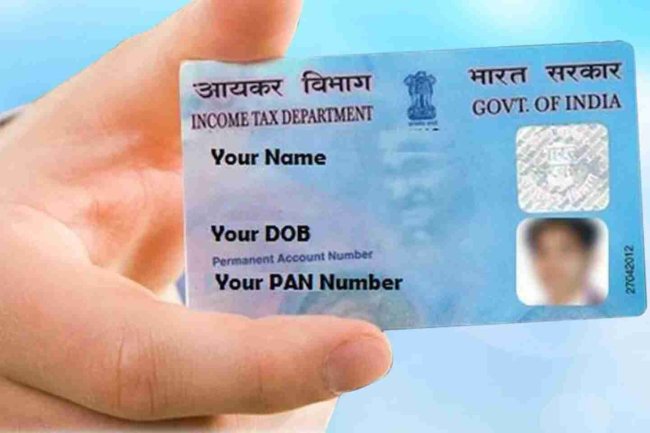

Apply PAN card online

A PAN (Permanent Account Number) is a 10-digit unique alphanumeric identifier issued by the Income Tax Department to Indian reside...