How to Apply for a PAN Card for NRIs: Your Complete Guide

Apply for PAN for NRIs NRIs (Non-Resident Indians) can easily apply for a PAN card online, which is essential for financial activities like filing taxes, making investments, or purchasing property in India. The application process can be completed through the NSDL or UTIITSL websites by filling out Form 49A or 49AA, uploading required documents (passport, overseas address proof), and paying the applicable fee. After submission, track your application status online, and receive the PAN card in 15-20 business days. Applying for a PAN card as an NRI is quick, straightforward, and essential for seamless financial dealings in India.

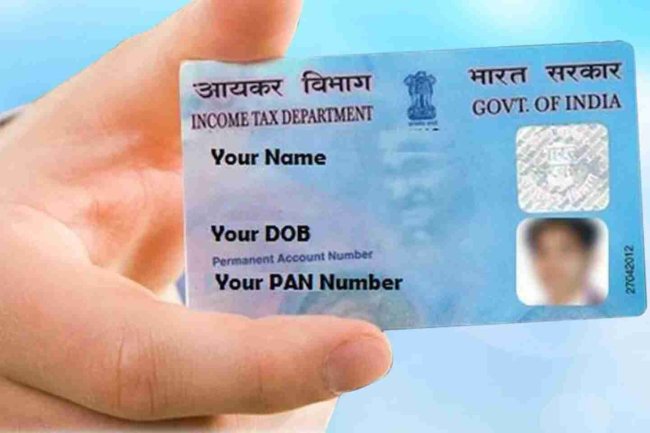

For NRIs (Non-Resident Indians), having a PAN (Permanent Account Number) card is crucial for conducting financial transactions in India. Whether you're investing in Indian stocks, purchasing property, or filing tax returns, a PAN card is necessary. This article explains how NRIs can apply for a PAN card, the documents needed, and the step-by-step process.

Why Do NRIs Need a PAN Card?

A PAN card is an essential identification tool for financial transactions in India. Here's why NRIs need a PAN card:

- Filing Income Tax Returns: NRIs earning income in India, such as rent, dividends, or capital gains, need a PAN to file taxes.

- Investing in Indian Markets: To invest in mutual funds, stocks, or bonds, a PAN card is required.

- Opening Bank Accounts: Most Indian banks require a PAN for NRIs to open bank accounts.

- Property Transactions: Buying or selling property in India requires a PAN.

- Receiving Payments: If you are receiving payments from an Indian entity, you'll need to furnish your PAN.

Types of PAN Application Forms for NRIs

There are two forms NRIs can use based on their status:

- Form 49A: For NRIs who are Indian citizens.

- Form 49AA: For foreigners or individuals with foreign citizenship but of Indian origin (PIO or OCI holders).

Documents Required for NRI PAN Card Application

When applying for a PAN card as an NRI, you'll need the following documents:

- Proof of Identity: Passport copy

- Proof of Address: Overseas address proof (such as a utility bill or bank statement)

- Two Passport-Size Photos

- Form 49A or 49AA (based on your nationality)

How to Apply for an NRI PAN Card Online: Step-by-Step

1. Choose the Authorized Portal: NSDL or UTIITSL

To begin, visit either the NSDL (www.tin-nsdl.com) or UTIITSL (www.utiitsl.com) websites. Both platforms allow you to submit online PAN card applications.

2. Fill Out the Appropriate Form

Depending on your status, select Form 49A (for Indian citizens) or Form 49AA (for foreign citizens or PIO/OCI holders). Enter your personal details, address, and other necessary information accurately.

3. Upload Supporting Documents

Upload scanned copies of your proof of identity, address, and passport-size photos. Ensure the documents are clear and self-attested.

4. Pay the Application Fee

The fee for applying for a PAN card varies depending on whether the PAN card is delivered to an Indian or overseas address. Payment can be made online via credit/debit cards, net banking, or demand draft.

5. Submit the Application

After filling out the form and completing the payment, submit the application. You will receive an acknowledgment number, which you can use to track the status of your PAN card.

6. Track and Receive Your PAN Card

You can track the status of your application on the NSDL or UTIITSL websites using the acknowledgment number. Once processed, the PAN card will be mailed to the address you provided in the form.

Common Questions About NRI PAN Card Application

1. Can NRIs Use an Overseas Address?

Yes, NRIs can use their overseas address, provided they submit valid proof of residence.

2. Do NRIs Need Aadhaar to Apply for PAN?

No, Aadhaar is not mandatory for NRIs when applying for a PAN card.

3. How Long Does It Take to Receive a PAN Card?

Typically, the process takes about 15-20 working days, depending on the location and the accuracy of the documents submitted.

Conclusion

Applying for a PAN card as an NRI is now simpler than ever, thanks to online application services. Whether you are conducting business, investing in India, or receiving income from Indian sources, having a PAN card is essential. Follow the steps in this guide to get your PAN card quickly and efficiently.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?