How to Apply for a PAN Card for Foreign Nationals: A Comprehensive Guide

Foreign nationals can apply for a PAN card to conduct financial transactions, pay taxes, or invest in India. The application can be submitted online through NSDL or UTIITSL by filling out Form 49AA. Required documents include proof of identity (passport, OCI/PIO card), proof of address (foreign address proof), and passport-sized photographs. After submitting the form and paying the application fee, you will receive a 15-digit acknowledgment number to track the application status. Processing usually takes 15-20 business days, and the PAN card will be mailed to the address provided.

Introduction:

A PAN (Permanent Account Number) card is an essential document for anyone conducting financial transactions in India, including foreign nationals. Whether you're investing in Indian markets, paying taxes, or buying property, having a PAN card is mandatory. This article outlines the complete process for foreign nationals to apply for a PAN card, required documents, and the steps involved in the online application process.

Why Do Foreign Nationals Need a PAN Card?

Foreign nationals may require a PAN card for various reasons, including:

- Investing in Indian markets: To invest in stocks, mutual funds, or other financial instruments.

- Filing income tax returns: To comply with Indian tax laws.

- Purchasing or selling property: For property transactions in India.

- Opening a bank account: Required for opening a bank account in India.

- Conducting high-value transactions: Necessary for transactions exceeding a certain amount.

Eligibility for Foreign PAN Card

Any foreign individual or entity involved in financial activities in India is eligible to apply for a PAN card. Both individuals and companies can obtain a PAN card to carry out financial and tax-related activities in India.

How to Apply for a Foreign PAN Card

Foreign nationals can apply for a PAN card online via official government portals. The two primary websites for applying are:

- NSDL (National Securities Depository Limited) – https://www.tin-nsdl.com

- UTIITSL (UTI Infrastructure Technology and Services Limited) – https://www.utiitsl.com

Step-by-Step Process:

Step 1: Visit the Official Website

- Go to the NSDL or UTIITSL website and select the option for "New PAN Card (Form 49AA)". This is the designated form for foreign nationals.

Step 2: Fill Out Form 49AA

- Foreign nationals must complete Form 49AA, which is required for non-Indian citizens. The form will ask for details such as:

- Full name

- Date of birth

- Nationality

- Foreign address

- Contact information

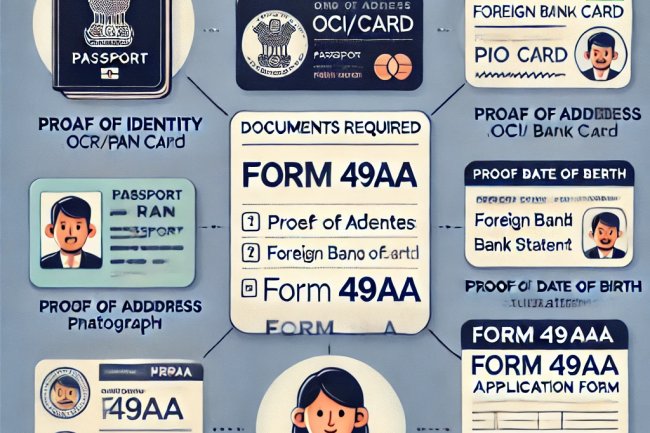

Step 3: Upload Required Documents

You will need to submit the following documents along with your application:

- Proof of Identity: Passport, Overseas Citizen of India (OCI) card, or Person of Indian Origin (PIO) card.

- Proof of Address: Foreign address proof, such as a utility bill, bank statement, or rental agreement.

- Photographs: Two recent passport-sized photos.

Step 4: Pay the Application Fee

- The fee for a PAN card for foreign nationals varies depending on the location of the delivery address. You can pay the fee online using a debit/credit card or through net banking.

Step 5: Submit the Application

- After completing the form and uploading the documents, submit your application online. You will receive a 15-digit acknowledgment number, which can be used to track the status of your application.

Important Documents for Foreign Nationals Applying for PAN Card:

- Proof of Identity: Passport, OCI/PIO card.

- Proof of Address: Foreign address proof (bank statement, utility bills, or lease agreement).

- Photographs: Two recent passport-sized photos.

How to Track Your PAN Card Application

Once you’ve submitted your PAN card application, you can track the status using the acknowledgment number provided on the NSDL or UTIITSL website. Processing typically takes 15-20 business days, after which the PAN card will be sent to the overseas address mentioned in the application.

Key Points to Remember:

- Form 49AA is specifically for foreign nationals applying for a PAN card.

- Ensure that all details and documents are accurate to avoid delays in processing.

- PAN cards will be mailed to the foreign address provided in the application.

- PAN card is necessary for foreign nationals engaging in financial activities or tax obligations in India.

Conclusion:

Applying for a PAN card as a foreign national is a straightforward process that can be completed online. Whether you're an individual looking to invest in India, a business entity, or someone with tax obligations, having a PAN card is essential. Follow the steps in this guide to apply for a foreign PAN card and ensure that your financial activities in India go smoothly.

If you want to apply NRI PAN card, apply through this link https://idserve.in/

What's Your Reaction?