How to Find PAN Card Details by Number: A Complete Guide

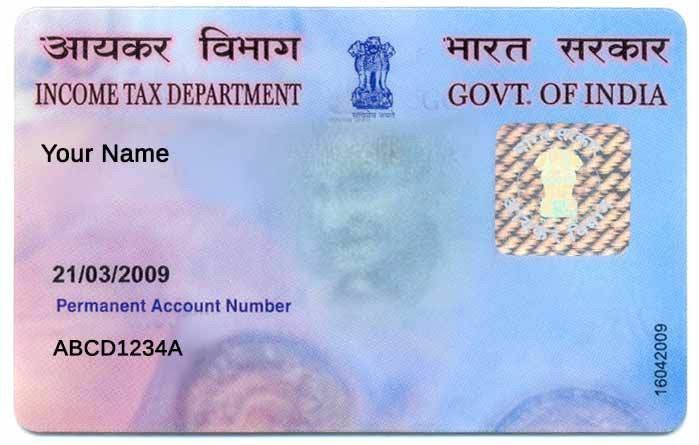

Introduction : The Permanent Account Number (PAN) is a unique 10-digit alphanumeric code issued by the Income Tax Department of India. It serves as a vital tool for all financial transactions, tax-related services, and identity verification in India. If you already know your PAN number but need to find additional details linked to it, such as your name or jurisdiction, there are simple online methods to retrieve this information. Here’s a complete guide on how to find PAN card details by number.

Why You May Need to Find PAN Card Details

Knowing just the PAN number may not always be enough for certain transactions or services. Here are some reasons why you might need to look up your PAN card details:

- Identity Verification: During financial transactions, institutions may require you to confirm the details associated with your PAN.

- Income Tax Filing: PAN details are crucial for filing income tax returns.

- Financial Transactions: High-value transactions, like buying property or investing in mutual funds, often require accurate PAN card details.

- Updating Records: You may need to cross-check PAN details when updating records with financial institutions, government services, or banks.

Steps to Find PAN Card Details by Number

Here’s how you can quickly and easily find PAN card details using your PAN number online:

1. Visit the Income Tax E-filing Website

- Go to the official Income Tax E-filing Portal.

- This portal provides a wide range of online services, including PAN verification and retrieval of PAN-related details.

2. Navigate to the PAN Verification Service

- Look for the ‘Verify Your PAN Details’ option, which can usually be found under the 'Services' or 'Quick Links' section.

- Click on the link to begin the process of verifying and retrieving PAN details using your PAN number.

3. Enter Your PAN Number

- You will be required to input your 10-digit PAN number in the field provided.

- Fill in additional details such as your date of birth (DOB) or name, if requested by the system.

4. Complete the CAPTCHA

- To ensure that the request is made by a legitimate user, you will be asked to complete a CAPTCHA code before proceeding. This helps to avoid automated spam requests.

5. Retrieve PAN Details

- After submitting your PAN number and completing the CAPTCHA, the system will display the details associated with your PAN, such as:

- Full Name: The name as registered with the Income Tax Department.

- Jurisdiction: The geographical area under which your PAN is registered.

- PAN Status: The current status of your PAN (active or inactive).

- These details can be used for verification or other purposes.

Alternative Methods to Find PAN Card Details

1. Using NSDL or UTIITSL Websites

If you cannot access the Income Tax Department's website, you can also use NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology and Services Limited) portals. These organizations manage PAN issuance and offer online services, including PAN verification by number.

- NSDL Portal: NSDL PAN Verification.

- UTIITSL Portal: UTIITSL PAN Services.

Simply navigate to their PAN services sections and input your PAN number to retrieve relevant details.

2. PAN Card Verification Through Banks or Financial Institutions

Many banks and financial institutions offer the option to verify PAN details as part of their KYC (Know Your Customer) process. If you are conducting financial transactions or opening accounts, your PAN number can be verified directly through these institutions' systems.

Important Considerations

- Ensure Accuracy: Ensure the PAN number you are entering is correct. Even a minor typo can prevent the retrieval of details.

- Privacy and Security: Be cautious when sharing your PAN number online. Only use official government websites like the Income Tax Department, NSDL, or UTIITSL for PAN-related services.

- Updating PAN Details: If you find discrepancies or outdated information while retrieving PAN details, you can request updates or corrections through NSDL or UTIITSL portals.

FAQs

1. Can I retrieve my PAN card details if I don’t know my PAN number?

Yes, if you don’t know your PAN number, you can retrieve it by using your name and other personal details through the Income Tax e-filing portal.

2. Is it possible to verify PAN details without a registered mobile number?

Yes, when retrieving PAN details by number, you typically do not need to enter a mobile number unless required for specific services like OTP-based verifications.

3. What should I do if my PAN number shows inactive?

If your PAN is inactive or there are issues with your PAN details, you should contact the Income Tax Department or visit the NSDL or UTIITSL portals to correct the issue.

Conclusion

Finding PAN card details by number is an easy and straightforward process, thanks to the online services provided by the Income Tax Department of India. Whether you’re verifying your identity, preparing for tax filings, or conducting financial transactions, knowing how to access your PAN details with just your PAN number can save you time and hassle. Always ensure that your PAN details are up to date, and use official channels to protect your privacy and security.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?