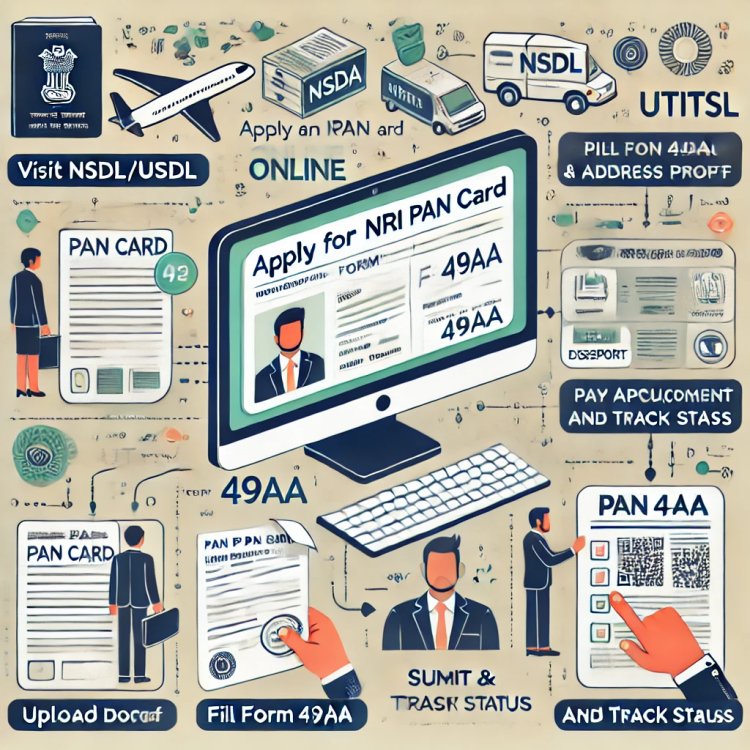

How to Apply for a New PAN Card as an NRI: A Step-by-Step Guide

New PAN Card Application Form for NRI: A Quick Guide NRIs (Non-Resident Indians) who need a PAN card for financial transactions or tax-related matters in India can easily apply online. To get started, you must fill out Form 49A, which is available on the NSDL or UTIITSL websites. You'll need to provide documents such as proof of identity (passport), proof of address (overseas or Indian), and proof of date of birth. After submitting the required documents and paying the application fee, your PAN card will be processed and delivered to your specified address. PAN cards are essential for NRIs who wish to invest in India or file taxes.

Applying for a PAN card as an NRI (Non-Resident Indian) is essential if you have taxable income or financial dealings in India. The process for NRIs is simple, and can be completed online by filling out the PAN card application form. This guide will help you understand how to apply for a new PAN card as an NRI.

Steps to Apply for a New PAN Card for NRIs:

-

Access the Application Form: NRIs can apply for a PAN card through the official NSDL or UTIITSL websites. Look for Form 49A, which is specifically for new PAN card applications.

-

Documents Required:

- Proof of Identity (Passport, Aadhaar card, etc.)

- Proof of Address (Overseas or Indian address)

- Proof of Date of Birth (Birth certificate, passport, etc.)

-

Filling Out the Form: Ensure all fields in Form 49A are accurately filled in, including details like your full name, address, and nationality. Ensure you select the correct NRI status when submitting the form.

-

Submit Documents: After completing the form, submit scanned copies of your required documents for identity and address verification.

-

Fee Payment: The application fee varies depending on whether the PAN card will be delivered to an address in India or abroad. Payment options include credit/debit cards, net banking, or demand draft.

-

Dispatch and Delivery: Once the application is processed, the PAN card will be dispatched to the specified address.

Key Considerations:

- Ensure that your details match those in your passport.

- PAN cards are essential for tax-related activities, opening bank accounts, and investments in India.

If you want to apply NRI PAN card, apply through this link https://idserve.in/

What's Your Reaction?