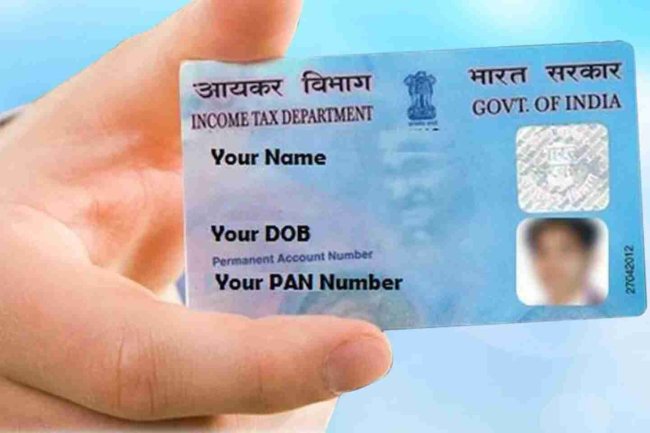

PAN Card for OCI Holders: A Complete Guide

A PAN (Permanent Account Number) card is mandatory for OCI (Overseas Citizen of India) holders who wish to engage in financial transactions in India. It is required for activities like investing in Indian stocks, buying property, opening bank accounts, and filing income tax returns. OCI holders can apply for a PAN card online via NSDL or UTIITSL websites. To apply, OCI holders need to submit documents such as their OCI card or passport for identity proof, address proof (Indian or foreign), and a passport-sized photograph. Processing usually takes a few weeks, and the PAN card can be delivered to both Indian and international addresses. A PAN card ensures compliance with Indian tax laws and simplifies financial dealings in India for OCI holders.

If you're an Overseas Citizen of India (OCI) holder, you may need a PAN (Permanent Account Number) card to carry out a variety of financial transactions in India. Whether you're planning to invest in Indian markets, purchase property, or earn income, a PAN card is essential for complying with Indian tax laws. It serves as a unique identifier for all financial activities and is mandatory for anyone earning taxable income in India, including OCI holders.

Why OCI Holders Need a PAN Card

As an OCI holder, a PAN card is required for a wide range of transactions and financial activities in India, including:

- Investing in Indian Stocks and Mutual Funds: A PAN card is essential for opening an investment account and trading in Indian securities.

- Purchasing Property: When buying or selling property in India, a PAN card is needed for legal and tax compliance.

- Filing Income Tax Returns: If you earn any taxable income in India, including rental income or dividends, a PAN card is necessary for filing taxes.

- Opening Bank Accounts: Many banks in India require a PAN card to open an account for non-residents, including OCI holders.

How to Apply for a PAN Card as an OCI Holder

- Online Application: OCI holders can apply for a PAN card online through the official NSDL or UTIITSL websites.

- Documents Required:

- Proof of identity (OCI card or passport)

- Proof of address (Indian or foreign address)

- Passport-sized photograph

- Application Fees: The fees vary based on whether the PAN card will be delivered to an Indian or foreign address.

- Processing Time: The PAN card is generally issued within a few weeks and can be sent to either an Indian or foreign address.

Benefits of Having a PAN Card for OCI Holders

- Ease of Transactions: A PAN card is necessary for a range of financial activities such as banking, investing, and property transactions.

- Compliance with Indian Tax Laws: Ensures that OCI holders meet their tax obligations in India.

- Investment Opportunities: Opens up opportunities for investing in the Indian market.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?