PAN Card Application Form for OCI Holders: A Step-by-Step Guide

PAN Card Application Form for OCI Holders: Quick Guide OCI (Overseas Citizen of India) holders need to apply for a PAN card using Form 49AA, which is specifically designed for foreign citizens. A PAN card is essential for financial transactions in India, such as filing taxes, opening bank accounts, and making investments. To apply, OCI holders must provide proof of identity (OCI card or passport), proof of address, and two passport-sized photographs. The application can be submitted online via the NSDL or UTIITSL portals, and fees vary based on the delivery address. Processing typically takes 15-30 days.

If you are an OCI (Overseas Citizen of India) holder and want to engage in financial transactions or investments in India, a PAN (Permanent Account Number) card is a must. The PAN card is a vital document issued by the Income Tax Department of India, and it serves as a unique identifier for individuals and entities involved in financial activities. For OCI holders, the PAN card is required for filing tax returns, opening bank accounts, purchasing property, and more. This article covers the details about the PAN card application form and how to apply as an OCI holder.

Which PAN Card Application Form Should OCI Holders Use?

OCI holders are considered foreign citizens for the purpose of applying for a PAN card. Therefore, they must fill out Form 49AA, which is designed specifically for individuals who are not Indian citizens but need a PAN for financial transactions in India.

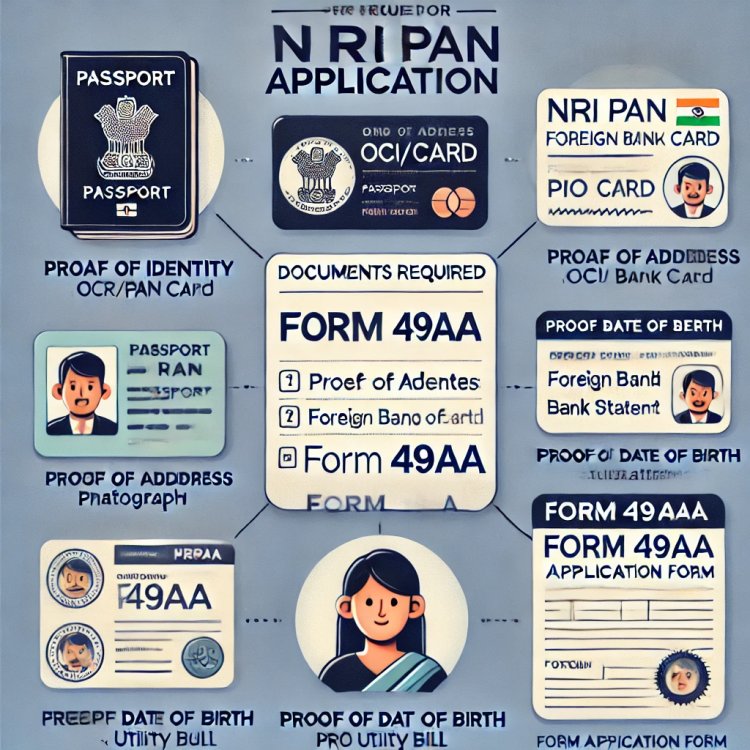

Documents Required for Form 49AA

When applying using Form 49AA, OCI holders need to submit supporting documents along with the application form. The key documents include:

- Proof of Identity: OCI card, passport, or other government-issued identification documents.

- Proof of Address: This can be a utility bill, Indian bank account statement, property registration document, or any government-issued address proof.

- Two Passport-Sized Photographs: Recent, colored photos to be affixed on the application form.

How to Fill and Submit PAN Card Application Form for OCI Holders

Here’s a step-by-step guide for OCI holders applying for a PAN card using Form 49AA:

-

Access the Application Form Online

- Go to the official PAN card application websites – either the NSDL (National Securities Depository Limited) portal or the UTIITSL (UTI Infrastructure Technology and Services Limited) portal.

-

Select Form 49AA

- Under the “New PAN” section, choose Form 49AA as this is the form designated for OCI holders and foreign nationals.

-

Fill in Personal Details

- Enter your full name, date of birth, contact details, and residential address. OCI holders can provide a foreign address if they reside outside of India.

-

Upload Supporting Documents

- Attach copies of your proof of identity and address. OCI cardholders need to submit copies of their OCI card and passport.

-

Pay the Application Fee

- The fee varies based on your communication address (within India or overseas). Payment can be made online via credit/debit cards, net banking, or demand draft.

-

Submit the Application

- Once the form is filled out and documents are uploaded, submit the form. You will receive an acknowledgment number that can be used to track the status of your application.

-

Verification and Delivery

- After submission, your application will be processed, and your PAN card will be delivered to your specified address. For OCI holders residing abroad, delivery may take longer.

Common Mistakes to Avoid When Filling Form 49AA

- Ensure that all details match the information on your OCI card or passport.

- Double-check that the photographs meet the specified requirements (size, background color).

- Make sure to submit the correct supporting documents to avoid application delays.

Conclusion

For OCI holders, obtaining a PAN card is crucial for conducting financial activities in India. Form 49AA is the required application form, and with the right documents and steps, the process is straightforward. By applying online and submitting the correct documentation, OCI holders can easily obtain their PAN card and stay compliant with India’s financial regulations.

If you want to apply NRI PAN card, apply through this link https://idserve.in/

What's Your Reaction?