Instant PAN: A Quick and Easy Guide

Introduction : The Indian government has made it incredibly simple to obtain a Permanent Account Number (PAN) through the Instant PAN service. This service is especially useful for individuals who need a PAN immediately for financial transactions or tax purposes. With the Instant PAN facility, you can generate your PAN within minutes, all through an entirely digital process.

What is Instant PAN?

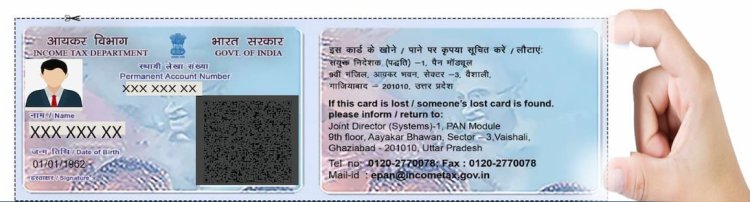

Instant PAN is a service provided by the Income Tax Department of India that allows individuals to generate a PAN card instantly using their Aadhaar number. The entire process is paperless and doesn’t require any physical documentation, making it quick, convenient, and eco-friendly.

Why You Might Need Instant PAN

-

Urgent Financial Transactions: If you need to make an urgent financial transaction that requires PAN, Instant PAN can help you obtain it immediately.

-

Filing Taxes: If you’re a first-time taxpayer and need a PAN to file your taxes, Instant PAN is a hassle-free way to get it.

-

Opening Bank Accounts: Banks require PAN for opening accounts, and Instant PAN ensures you can meet this requirement without delay.

-

Applying for Credit Cards or Loans: Financial institutions often require PAN for credit card or loan applications, and Instant PAN provides a quick solution.

How to Apply for Instant PAN

Applying for Instant PAN is a straightforward process that can be completed in just a few minutes. Here’s how you can do it:

-

Visit the Income Tax e-Filing Portal: Go to the official website https://www.incometax.gov.in.

-

Select ‘Instant PAN through Aadhaar’: This option is available under the ‘Quick Links’ section on the homepage.

-

Enter Your Aadhaar Number: You’ll be required to enter your 12-digit Aadhaar number. Ensure that your Aadhaar is linked with your mobile number for OTP (One Time Password) verification.

-

Verify Your Aadhaar Details: An OTP will be sent to your registered mobile number. Enter the OTP to verify your details.

-

Generate PAN: Once the OTP is verified, your PAN will be generated instantly. You can download the e-PAN from the portal, and a copy will also be sent to your registered email address.

Benefits of Instant PAN

-

Quick and Paperless: The entire process is digital, requiring no paperwork or physical submission of documents.

-

Cost-Free: The Instant PAN service is completely free of charge.

-

Secure: The process is secure as it uses OTP-based verification linked to your Aadhaar.

-

Instant Download: You can download your e-PAN immediately after it's generated, which serves as a valid PAN card.

-

No Physical PAN Required: The e-PAN is a valid and accepted document across India for all financial and tax-related purposes.

Limitations of Instant PAN

-

Aadhaar Link Required: You can only use this service if your Aadhaar is linked with your mobile number.

-

Individuals Only: This service is available only for individuals, not for companies, HUFs, or other entities.

-

Single PAN: If you already have a PAN, you should not apply for another through this service as holding multiple PANs is illegal.

How to Reprint PAN After Using Instant PAN

If you need a physical copy of your PAN after generating it through the Instant PAN service, you can request a reprint:

-

Visit the NSDL or UTIITSL Portal: These are the authorized portals for PAN services.

-

Fill Out the Request Form: Provide your PAN details and personal information as required.

-

Pay the Reprint Fee: There’s a nominal fee for getting a physical copy of your PAN card.

-

Receive Your PAN Card: The physical PAN card will be mailed to your registered address.

Conclusion

The Instant PAN service is a revolutionary step by the Indian government to streamline the process of obtaining a PAN. It eliminates the need for lengthy paperwork and waiting periods, making it easier than ever to access this vital document. Whether you're new to the financial system or simply need a PAN quickly, Instant PAN is your go-to solution.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?