How to Know Your PAN Details Using Your PAN Number: A Step-by-Step Guide

Introduction : Your Permanent Account Number (PAN) is more than just a unique identifier—it's a vital part of your financial identity in India. Whether you're filing taxes, applying for loans, or making high-value transactions, your PAN plays a key role. But what if you need to verify or retrieve your PAN details? This guide will walk you through how to know your PAN details using your PAN number.

Why You Might Need to Know Your PAN Details

Knowing your PAN details is essential for:

- Filing Income Tax Returns: Accurate PAN details are necessary for tax filings.

- KYC (Know Your Customer) Verification: Banks and financial institutions use your PAN for identity verification.

- Financial Transactions: Certain transactions require your PAN details for processing.

- Tracking Financial History: Ensure your PAN is not being misused or associated with any fraudulent activity.

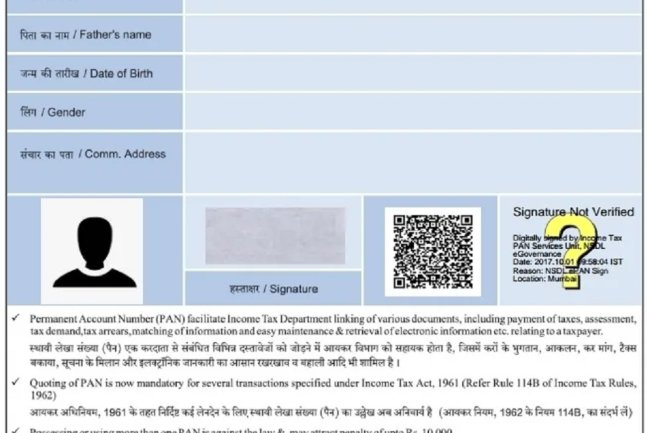

What PAN Details Can You Retrieve?

Using your PAN number, you can access various details including:

- Name: The full name associated with your PAN.

- Date of Birth: Your date of birth as registered with the Income Tax Department.

- PAN Status: Whether your PAN is active, inactive, or has any issues.

- Jurisdiction: The tax jurisdiction associated with your PAN.

- Linked Mobile Number: The phone number registered with your PAN for receiving OTPs and notifications.

Steps to Know Your PAN Details Using Your PAN Number

1. Visit the Income Tax E-filing Portal

The first step to retrieve your PAN details is to visit the Income Tax e-filing portal. This is the official website managed by the Income Tax Department of India.

2. Log In or Register

- If you already have an account, log in using your user ID (which is usually your PAN) and password.

- If you’re a first-time user, you’ll need to register by providing your PAN number, full name, date of birth, and mobile number.

3. Navigate to 'My Profile'

Once logged in, go to the ‘My Profile’ section, which can be found under the ‘Profile Settings’ tab. Here, you will be able to view all the details associated with your PAN, including your name, date of birth, and other relevant information.

4. Use the 'Know Your PAN' Service

If you want to verify your PAN details without logging in, you can use the 'Know Your PAN' service available on the Income Tax Department's website:

- Step 1: Visit the Know Your PAN page.

- Step 2: Enter your personal details, such as your full name, date of birth, and registered mobile number.

- Step 3: You will receive an OTP (One-Time Password) on your registered mobile number. Enter the OTP to proceed.

- Step 4: Your PAN details will be displayed on the screen, including your PAN number, full name, and status.

5. Check PAN Details Through NSDL or UTIITSL

You can also check your PAN details through the NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology Services Limited) websites, especially if you applied for your PAN through these platforms:

- Visit their respective websites and use the PAN verification service by entering your PAN number and other required details.

What to Do If You Find Discrepancies

If you discover any discrepancies in your PAN details, such as incorrect spelling of your name or wrong date of birth, you should:

- Apply for Correction: Use the PAN correction form available on the Income Tax Department's website or through NSDL/UTIITSL.

- Submit Supporting Documents: Provide proof of the correct details, such as your Aadhaar card, passport, or voter ID.

- Monitor the Status: After submitting the correction request, monitor the status online to ensure the changes are processed.

Conclusion

Knowing your PAN details using your PAN number is a simple and essential task that helps you manage your financial identity. Whether you're preparing for tax season, completing KYC formalities, or ensuring your details are accurate, following the steps in this guide will make the process easy and efficient.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?