How to Find Your PAN Number if You’ve Lost Your PAN Card: A Complete Guide

Losing your PAN card can be stressful, as it's a vital document for financial and tax-related activities. However, the good news is that if you’ve lost your PAN card, you can still easily retrieve your PAN number online using simple methods provided by the government. In this article, we’ll guide you through the steps to find your PAN number if your PAN card is lost.

Why Do You Need Your PAN Number?

Your Permanent Account Number (PAN) is essential for:

- Filing income tax returns

- Opening bank accounts

- Making high-value transactions

- Receiving taxable income

- Investing in stocks, mutual funds, and property

Losing your PAN card doesn’t mean losing access to your PAN number. Thanks to digital services, you can retrieve your PAN number with just a few clicks.

Steps to Find Your PAN Number If You Lost Your PAN Card

1. Visit the Income Tax E-Filing Website

The easiest way to find your PAN number online is by visiting the official Income Tax e-Filing portal at www.incometax.gov.in.

2. Select the ‘Know Your PAN’ Option

Once you’re on the website, look for the ‘Know Your PAN’ service under the "Quick Links" section. This service allows you to retrieve your PAN number using basic information.

3. Provide Your Personal Information

To retrieve your PAN number, you will need to enter the following details:

- Full name (as per your PAN card)

- Date of birth

- Father’s name (optional but recommended)

Ensure that these details match what you provided when applying for your PAN card to avoid any errors.

4. Enter Your Registered Mobile Number

Next, you’ll be asked to input your registered mobile number. This is the number you provided while applying for your PAN card. If your number has changed, you may need to update it first before retrieving your PAN number.

5. Complete OTP Verification

An OTP (One-Time Password) will be sent to your registered mobile number. Enter the OTP to verify your identity.

6. View Your PAN Number

Once the OTP is successfully verified, your PAN number will be displayed on the screen. You can take a screenshot or note it down for future reference.

Alternative Ways to Retrieve Your PAN Number

1. Check Your Previous Financial Documents

Your PAN number may be listed in several documents, including:

- Income tax return filings

- Form 16 (issued by your employer)

- Bank statements

- Investment documents

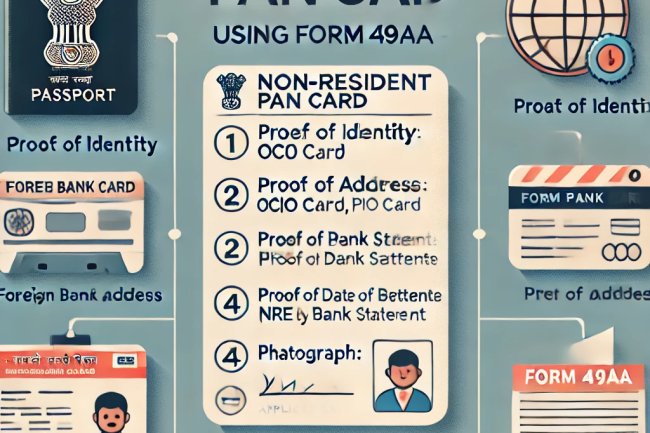

2. Request a Duplicate PAN Card

If you need a physical copy of your PAN card, you can apply for a duplicate PAN card. Here’s how:

- Visit the NSDL or UTIITSL website.

- Select the option for Reprint PAN Card.

- Fill in the required details and submit the form.

- Pay the nominal fee and your PAN card will be sent to your registered address.

3. Contact the Income Tax Department Helpline

If you are unable to retrieve your PAN number online, you can contact the Income Tax Department helpline at 1800-180-1961 or 1961 for assistance. They can guide you on how to recover your PAN number.

Keep Your PAN Number Safe

Once you retrieve your PAN number, it’s important to keep it safe and secure. You may consider storing it in a secure file or using an app that safely manages your personal documents. This will save you from potential issues in the future.

Conclusion

Losing your PAN card doesn’t mean you lose access to your PAN number. Using online services from the Income Tax Department, you can quickly retrieve your PAN number in case of loss or misplacement. Make sure to follow the steps above to recover your PAN and apply for a duplicate PAN card if necessary.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?