How to Check Your PAN Card Number Online: A Complete Guide

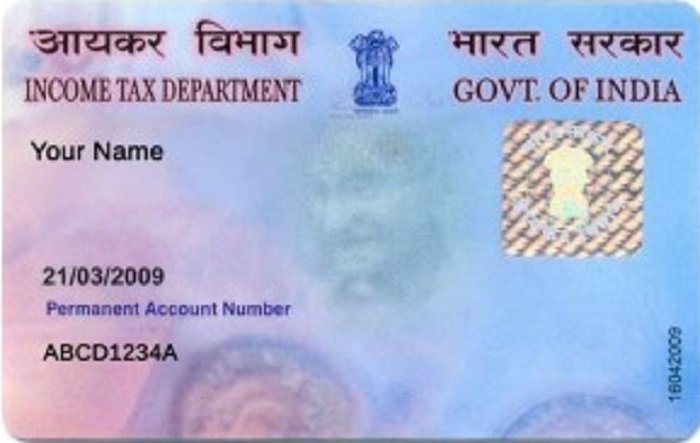

Introduction : The Permanent Account Number (PAN) is a crucial identification tool for taxpayers in India. Issued by the Income Tax Department, it is used for various financial transactions, filing income tax returns, and KYC verification processes. Whether you’ve forgotten your PAN card number or need to verify the PAN associated with your name, the good news is that you can easily check your PAN card number online. In this article, we will guide you through the process of checking your PAN card number online and provide insights on why it’s important to verify your PAN.

Why Do You Need to Check Your PAN Card Number?

There are several reasons why you might need to check your PAN card number:

- Forgot PAN Number: If you’ve misplaced your PAN card or forgotten the PAN number, you can retrieve it online.

- Verify PAN Number for Tax Filing: Before filing your Income Tax Returns (ITR), it’s crucial to ensure that the correct PAN is linked to your tax account.

- KYC for Financial Transactions: Banks, financial institutions, and other service providers often require PAN details as part of their Know Your Customer (KYC) process.

- Multiple PAN Cards: If you suspect you have multiple PAN cards issued in your name, it’s essential to check and cancel any duplicate PAN.

Steps to Check Your PAN Card Number Online

1. Using the Income Tax e-Filing Portal

The easiest and most reliable way to check your PAN number is through the official Income Tax Department’s e-filing website.

Step-by-Step Guide:

- Step 1: Visit the Income Tax e-Filing Portal at https://www.incometax.gov.in.

- Step 2: Under the "Quick Links" section, click on "Know Your PAN".

- Step 3: You will be asked to enter the following details:

- Full Name (as per PAN records)

- Date of Birth

- Mobile Number registered with PAN

- Step 4: You will receive a One-Time Password (OTP) on your registered mobile number. Enter the OTP to proceed.

- Step 5: After OTP verification, your PAN card number and related details will be displayed on the screen.

2. Using the Aadhaar Number to Check PAN

If your PAN card is linked with your Aadhaar number, you can retrieve your PAN details through the e-filing portal.

Step-by-Step Guide:

- Step 1: Visit the Income Tax e-Filing website.

- Step 2: Look for the "Link Aadhaar" option.

- Step 3: Enter your Aadhaar Number and the required details.

- Step 4: After OTP verification, your PAN number will be displayed if it is linked to your Aadhaar.

3. Checking PAN Status via NSDL or UTIITSL

You can also check your PAN card number or status using the official portals of NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology and Services Limited).

Step-by-Step Guide:

- Step 1: Visit the NSDL website (https://www.tin-nsdl.com) or the UTIITSL portal (https://www.pan.utiitsl.com).

- Step 2: Look for the "PAN Verification" or "Check PAN Status" section.

- Step 3: Enter your details, such as your name and date of birth.

- Step 4: After submitting, the system will retrieve and display your PAN number and related information.

4. Using Third-Party Services for PAN Verification

Several third-party websites offer PAN verification services. However, it is recommended to use only government-authorized platforms like the Income Tax Department, NSDL, or UTIITSL for checking your PAN card number to ensure data security.

Important Notes:

- Ensure Accuracy: Make sure that the name, date of birth, and other details you enter match exactly with the records linked to your PAN card.

- Mobile Number Requirement: The registered mobile number is crucial for receiving the OTP during the PAN verification process.

- Avoid Unauthorized Platforms: Always use official websites to ensure that your sensitive financial information is not compromised.

Why Verifying Your PAN Online is Important

- Avoid Legal Penalties: Holding multiple PAN cards is illegal and can lead to fines. Checking your PAN number online helps in identifying and canceling duplicate PAN cards.

- Ensure Correct Tax Filings: Verifying your PAN ensures that your tax filings and financial transactions are properly tracked and linked to the right PAN number.

- Smooth Financial Transactions: Whether you're applying for a loan, opening a bank account, or investing in stocks, verifying your PAN ensures hassle-free processing.

Conclusion

Checking your PAN card number online is a simple process that can be done within minutes through the official Income Tax Department portal or other authorized platforms like NSDL and UTIITSL. It’s an essential step in ensuring the accuracy of your PAN details, which is critical for tax compliance and financial transactions. Always ensure that your PAN information is up-to-date and accurate to avoid any legal or financial complications.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?