How to Check Your PAN Card Number Online

Introduction : Your Permanent Account Number (PAN) is a crucial identification number issued by the Income Tax Department of India. It is essential for filing taxes, conducting financial transactions, and verifying identity. Whether you've misplaced your PAN card or simply forgotten your PAN number, checking your PAN card number online is a simple and quick process. In this article, we’ll guide you through how to check your PAN card number using online platforms.

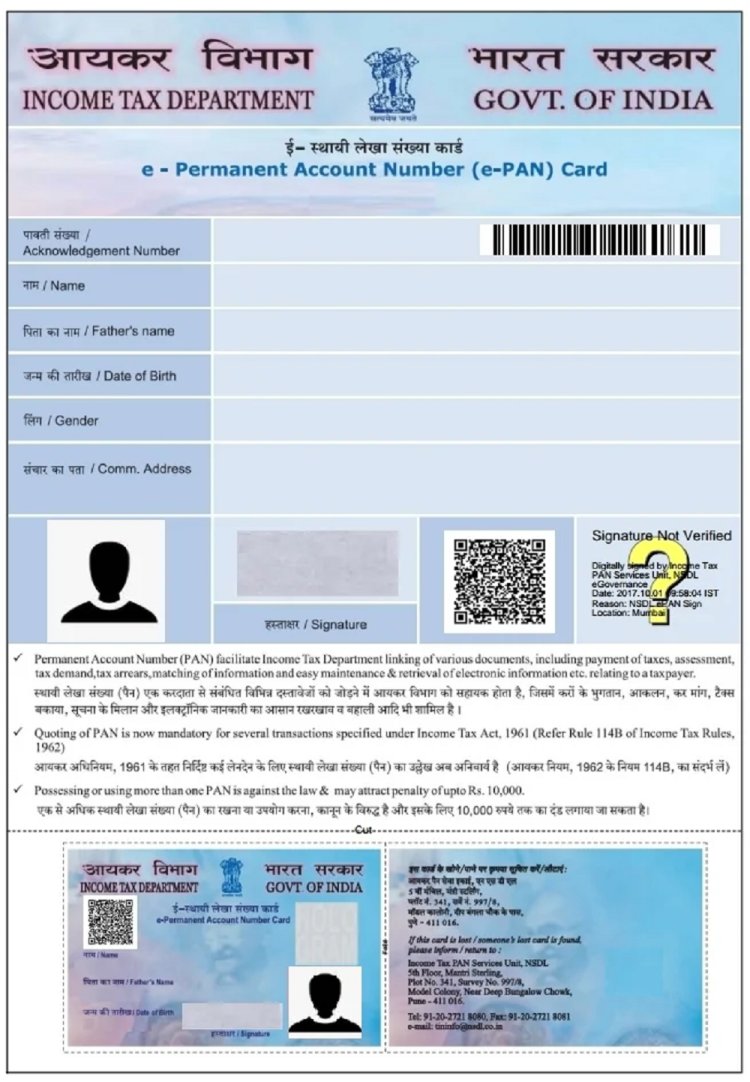

What is a PAN Card?

A PAN card is a 10-digit alphanumeric identifier that is unique to every taxpayer in India. It serves as proof of identity and is required for a variety of activities, including:

- Filing income tax returns

- Conducting high-value financial transactions

- Opening bank accounts

- Purchasing or selling real estate

- Applying for loans or credit cards

Losing your PAN card or forgetting your PAN number can be frustrating, but there are easy methods to retrieve or verify it online.

Why Would You Need to Check Your PAN Card Number?

There are several situations where you might need to check your PAN card number:

- You’ve misplaced or lost your physical PAN card.

- You forgot your PAN number and need it for tax filing or financial transactions.

- You want to verify the PAN number associated with a registered account.

- You need to cross-check PAN details for any inconsistencies.

How to Check Your PAN Card Number Online

Here’s how you can check your PAN card number online using various methods.

Method 1: Through the Income Tax e-Filing Portal

The easiest way to check your PAN card number is through the official Income Tax e-Filing portal. Follow these steps:

Step 1: Visit the Official Website

Go to the Income Tax e-Filing portal and log in to your account. If you don’t have an account, you will need to register using your personal details such as your Aadhaar number, mobile number, and email address.

Step 2: Navigate to "My Account" Section

Once logged in, go to the "My Account" section on the dashboard. Here, you’ll find an option called "View PAN Details."

Step 3: Check Your PAN Card Number

Click on "View PAN Details" to see your PAN card number along with your name, date of birth, and jurisdiction.

Method 2: Through the “Know Your PAN” Service

If you don’t have an account on the Income Tax e-Filing portal, you can use the “Know Your PAN” service to retrieve your PAN number by providing your name and date of birth.

Step 1: Visit the Income Tax e-Filing Portal

Go to the official Income Tax e-Filing website and click on the “Know Your PAN” link.

Step 2: Enter Your Details

You’ll need to enter your full name, date of birth (DOB), and your registered mobile number. Ensure that these details match what’s registered with your PAN.

Step 3: Submit OTP and Retrieve PAN

After submitting your details, an OTP will be sent to your registered mobile number. Enter the OTP, and once verified, your PAN number will be displayed on the screen.

Method 3: Via NSDL or UTIITSL Portals

You can also check your PAN card number through the NSDL or UTIITSL portals:

Step 1: Visit NSDL/UTIITSL Website

Go to the official NSDL or UTIITSL websites.

Step 2: Enter Your Details

Select the "Know Your PAN" or "PAN Status" option and enter your personal information, including your full name and date of birth.

Step 3: Retrieve PAN Number

Once verified, your PAN card number will be shown on the screen.

Other Methods to Check PAN Card Number

-

Through Aadhar Link: If your PAN is linked to your Aadhaar number, you can retrieve it using the same method by visiting the official Aadhaar portal.

-

Income Tax Helpline: If you are unable to check your PAN number online, you can contact the Income Tax Department helpline for assistance.

Security Tips

- Always use official portals like Income Tax e-Filing, NSDL, or UTIITSL to check your PAN details.

- Avoid sharing your PAN number or personal details with untrusted websites or third-party services.

- Keep a digital copy of your PAN card for quick access in the future.

Conclusion

Checking your PAN card number online is a fast and secure process that you can complete within minutes. Whether you need your PAN for tax purposes or a financial transaction, following these steps will help you retrieve or verify your PAN number with ease. Always use official government portals to ensure the safety of your personal data.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?