How to Check PAN Card Details Online: A Quick and Easy Guide

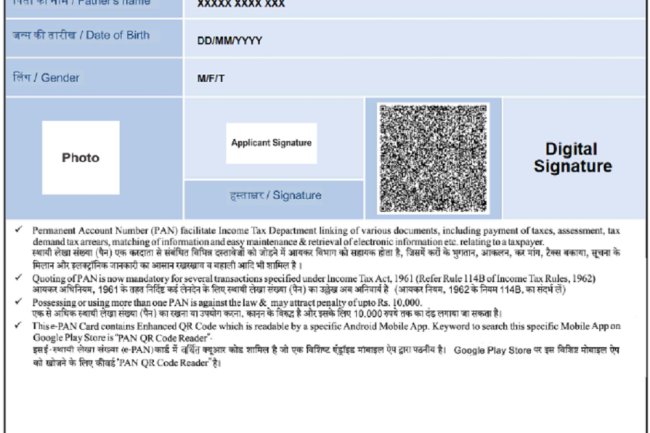

Introduction : The Permanent Account Number (PAN) is a vital identification tool for taxpayers in India. Issued by the Income Tax Department, PAN is essential for a variety of financial transactions, from filing taxes to opening bank accounts. If you need to verify or check your PAN card details online, the process is simple and straightforward. This guide will walk you through the steps to access your PAN details online.

Steps to Check PAN Card Details Online

-

Visit the Income Tax e-Filing Website

- The first step is to visit the official Income Tax e-Filing website: https://www.incometax.gov.in/.

-

Login to Your Account

- If you already have an account, enter your User ID (usually your PAN), password, and captcha to log in.

- If you are a new user, click on the “Register” option and complete the registration process with your PAN number and other required details.

-

Navigate to ‘Profile Settings’

- After logging in, go to the “Profile Settings” section. Here, you’ll find an option to view and update your PAN details.

-

Check Your PAN Details

- In the “Profile Settings” section, you will be able to view your PAN details, including your full name, date of birth, and PAN number. Ensure that all the details are correct.

-

Alternative Method: Use the ‘Know Your PAN’ Service

- If you do not want to log in or register, you can use the “Know Your PAN” service available under the Quick Links section of the Income Tax e-Filing website. Enter your name, date of birth, and mobile number to retrieve your PAN details.

-

Third-Party Websites

- Some authorized third-party websites also offer PAN verification services. These platforms allow you to check your PAN card details by entering your PAN number. However, always ensure that the website is secure and authorized by the government.

Why Checking Your PAN Details Online is Important

Regularly checking your PAN card details ensures that all your information is correct and up-to-date. Inaccurate details can lead to issues when filing taxes or during financial transactions. If you spot any discrepancies, you can request corrections through the Income Tax Department's online portal.

Troubleshooting and FAQs:

-

What if I forget my password?

- You can reset your password by clicking on the “Forgot Password” option on the login page. Follow the prompts to reset it.

-

What if my details are incorrect?

- If you notice any incorrect details on your PAN, you can request a correction by filling out the “PAN Correction Form” available on the NSDL or UTIITSL websites.

-

How often should I check my PAN details?

- It’s a good practice to check your PAN details whenever you file your income tax returns or if you’ve recently made any updates to your personal information.

Conclusion:

Verifying your PAN card details online is a quick and easy process that ensures your financial transactions and tax-related activities proceed smoothly. With just a few clicks, you can access and confirm all the necessary information related to your PAN card.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455)

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?