How to Apply for an NRI PAN Card: Step-by-Step Guide

NRIs (Non-Resident Indians) can easily apply for a PAN (Permanent Account Number) card online through Form 49AA, which is required for financial transactions like investing in Indian stocks, buying property, and filing tax returns. The process is simple: gather the required documents (passport, proof of address), visit the official PAN application portals (NSDL or UTIITSL), fill out Form 49AA, and pay the fees. After submission, you’ll receive an acknowledgment number to track your application. The PAN card will be delivered to your specified address, including international locations, within 15-20 business days.

A PAN (Permanent Account Number) is essential for Non-Resident Indians (NRIs) to conduct financial transactions in India. Whether you want to invest in Indian markets, manage property, or file taxes, a PAN card is required. NRIs must apply for their PAN card using Form 49AA, which is specifically designed for individuals residing outside India.

This guide will help you understand the process of applying for an NRI PAN card and ensure you have everything you need to make the application process smooth and hassle-free.

Why Do NRIs Need a PAN Card?

A PAN card allows NRIs to:

- Invest in Indian stocks or mutual funds

- Purchase or sell property in India

- Open an NRI bank account in India

- File income tax returns if they have taxable income in India

- Avoid higher TDS rates, which apply to transactions over ₹50,000 without a PAN card

How to Apply for an NRI PAN Card

Step 1: Gather Required Documents For NRIs, you will need the following documents:

- Proof of Identity: Passport, Overseas Citizen of India (OCI) card, or Person of Indian Origin (PIO) card.

- Proof of Address: Passport, OCI/PIO card, or a bank statement from your country of residence.

- Photographs: Two recent passport-sized photos.

Step 2: Choose an Online Portal NRIs can apply for a PAN card online through official portals like:

- NSDL (https://www.tin-nsdl.com)

- UTIITSL (https://www.utiitsl.com)

Choose Form 49AA from the available options since it is specifically for foreign citizens and NRIs.

Step 3: Fill Out Form 49AA

- Fill out your personal details, including your name, date of birth, and nationality.

- Upload scanned copies of your documents in the required format.

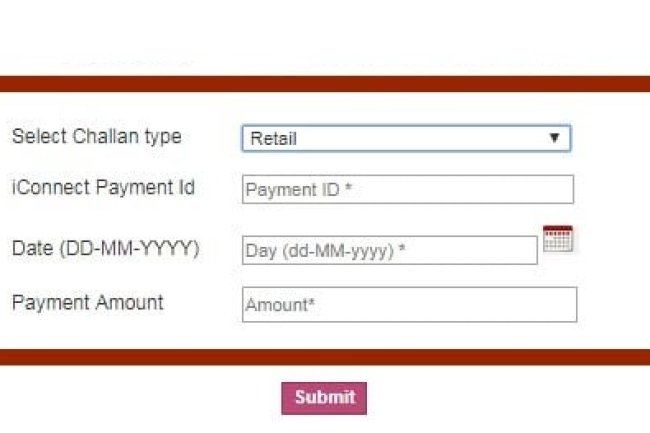

Step 4: Pay the Application Fee NRIs have to pay a slightly higher fee than resident Indians, especially if their communication address is outside India. Payment can be made online via credit/debit cards or through net banking.

Step 5: Submit the Application After completing the form and making the payment, you will receive an acknowledgment number. Use this number to track the status of your PAN card application.

Step 6: Receive Your PAN Card Once processed, your PAN card will be delivered to your provided address. If you live outside India, the card will be mailed to your overseas address.

Important Points to Remember:

- NRIs do not need an Aadhaar card to apply for a PAN card.

- Always double-check the documents you submit to avoid any application rejections.

- If you're residing abroad, additional postage charges may apply.

Frequently Asked Questions (FAQ)

1. Can NRIs apply for a PAN card from outside India? Yes, NRIs can apply for a PAN card online through NSDL or UTIITSL and receive it at their overseas address.

2. Is it necessary for NRIs to file taxes in India? If you have taxable income in India, you must file income tax returns using your PAN card. Otherwise, having a PAN card can simplify financial transactions in India.

3. What happens if an NRI doesn’t have a PAN card? Without a PAN card, NRIs may face difficulties in managing Indian investments, property dealings, or banking. Additionally, higher TDS (Tax Deducted at Source) rates may apply on certain transactions.

Conclusion

Applying for a PAN card as an NRI is straightforward when you follow the correct steps and submit the necessary documents. A PAN card will make it easier for you to manage your financial matters in India, from investments to property purchases and tax filings.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?