How to Apply for a PAN Card Online as an NRI: A Complete Guide

PAN Card Apply Online for NRI: A Simple Guide NRIs (Non-Resident Indians) can easily apply for a PAN card online through the official NSDL or UTIITSL websites. The process requires filling out Form 49AA, designed for NRIs and foreign citizens. Applicants must provide essential documents, including a passport (as proof of identity), overseas or Indian address proof, and two passport-size photographs. The application fee is INR 107 for an Indian address and INR 1,101 for a foreign address (including courier charges). NRIs can track their application online and typically receive the PAN card within 15-30 days.

Introduction:

For Non-Resident Indians (NRIs), a PAN (Permanent Account Number) card is essential for handling financial transactions in India. Whether you need to file taxes, invest in Indian stocks, purchase property, or open a bank account, a PAN card is mandatory. The good news is that NRIs can easily apply for a PAN card online from anywhere in the world. This guide will walk you through the online application process, required documents, and fees.

Why NRIs Need a PAN Card:

NRIs require a PAN card for various financial activities in India, including:

- Filing income tax returns

- Opening a bank account

- Investing in mutual funds, stocks, or bonds

- Buying or selling property

- Repatriating funds abroad

Without a PAN card, many of these transactions become difficult or impossible.

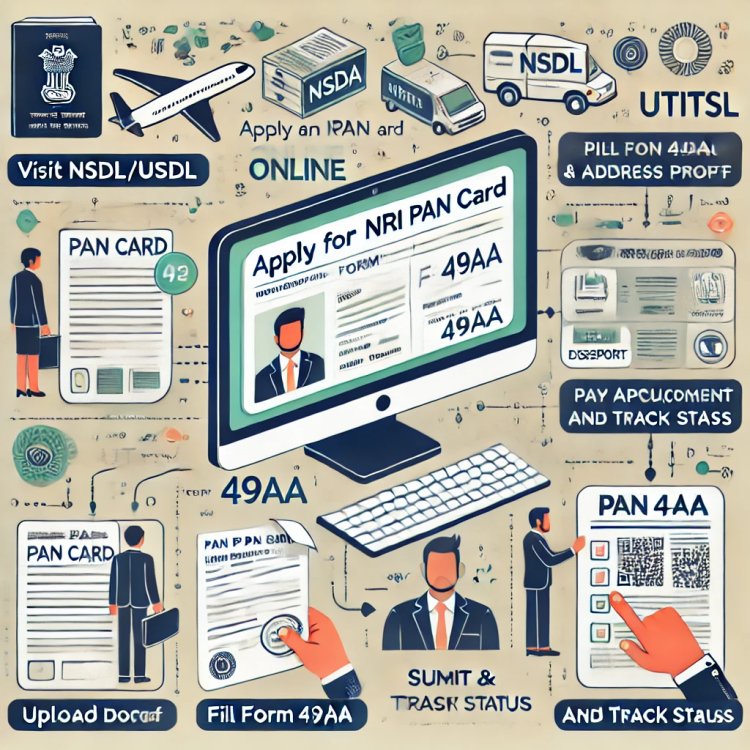

Step-by-Step Guide to Apply for a PAN Card Online for NRIs:

1. Visit the Official Website

- NRIs can apply for a PAN card through the NSDL or UTIITSL website. These are the two official authorities that process PAN applications.

2. Select Form 49AA

- NRIs must fill out Form 49AA, which is designated for foreign citizens, entities, and NRIs.

3. Fill in Personal Details

- Provide your full name, date of birth, communication address (either Indian or foreign), and citizenship details.

- Select your appropriate category: individual, trust, firm, etc.

4. Upload Required Documents

- Proof of Identity: Passport is mandatory for NRIs.

- Proof of Address: You can use an overseas address or an Indian address. Utility bills or bank statements are acceptable.

- Photographs: Two passport-size photos.

5. Pay the Fees

- For an Indian address, the fee is INR 107.

- For a foreign address, the fee is INR 1,101, which includes international courier charges.

6. Submit the Application and Track the Status

- After submitting the form and paying the fee, you will receive an acknowledgment slip with a tracking number. You can use this number to track your PAN card application online.

Documents Required for NRI PAN Card Application:

- Proof of Identity: Passport (mandatory for NRIs)

- Proof of Address: Overseas address proof or Indian address proof

- Photographs: Two recent passport-sized photographs

- Proof of Date of Birth: Birth certificate, passport, or school leaving certificate

PAN Card Fees for NRIs:

- For Indian Address: INR 107

- For Foreign Address: INR 1,101 (including international courier charges)

FAQs:

1. Can NRIs apply for a PAN card online?

Yes, NRIs can easily apply for a PAN card online through the NSDL or UTIITSL websites by filling out Form 49AA.

2. How long does it take to receive the PAN card?

It usually takes 15-30 days to receive the PAN card, depending on whether it’s delivered to an Indian or overseas address.

3. Is it mandatory for NRIs to have a PAN card?

Yes, a PAN card is necessary for NRIs who engage in any financial transactions in India, such as tax filing or investing.

Conclusion:

Applying for a PAN card online as an NRI is a straightforward process. By following this step-by-step guide, you can easily fill out the necessary forms, submit your documents, and pay the fees online. Having a PAN card is crucial for all financial transactions in India, and the convenience of online application ensures that NRIs can apply from anywhere in the world.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?