How to Find Your PAN Card Number by Name: A Comprehensive Guide

Introduction : The Permanent Account Number (PAN) is a crucial financial identifier for individuals and entities in India. Whether it's for filing taxes, opening a bank account, or making significant financial transactions, your PAN number is essential. But what if you forget your PAN number and don’t have access to your card? Don’t worry! You can retrieve your PAN number by using your name. In this article, we'll guide you through the steps to find your PAN card number by name.

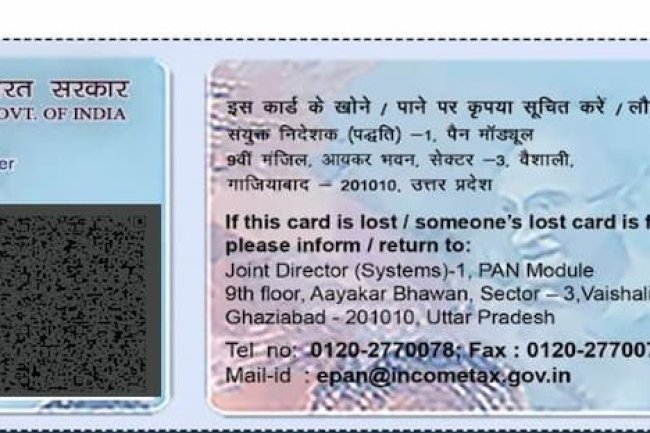

What is a PAN Card?

A PAN card is a unique 10-digit alphanumeric identifier issued by the Income Tax Department of India. It serves as a key identification number for financial and tax-related transactions. Whether you're an individual, a business, or a foreign entity operating in India, a PAN card is vital for legal compliance and financial transparency.

Why Might You Need to Find Your PAN Number by Name?

There are several situations where you might need to find your PAN number by name:

- Lost PAN Card: If you’ve lost your PAN card and don’t have a copy of your PAN number.

- Forgot PAN Number: If you can't remember your PAN number and need it for a financial transaction or tax filing.

- No Access to Documents: If you don't have access to previous financial documents that list your PAN number.

Steps to Find PAN Card Number by Name

1. Visit the Income Tax e-Filing Portal

The easiest way to find your PAN number by name is through the Income Tax Department’s e-Filing portal. Follow these steps:

-

Go to the Official Website: Visit the Income Tax e-Filing website at https://www.incometax.gov.in.

-

Click on 'Know Your PAN': On the homepage, look for the 'Know Your PAN' option. This feature allows you to search for your PAN number using your name and other personal details.

-

Enter Required Details: Fill in your personal information, including your:

- Full name (as per PAN records)

- Date of birth

- Father's name

- Mobile number

-

Verify Your Identity: After entering your details, you’ll be required to verify your identity through a One-Time Password (OTP) sent to your registered mobile number.

-

Retrieve Your PAN: Once your identity is verified, your PAN number will be displayed on the screen. Make sure to note it down for future reference.

2. Use the NSDL Portal

Another way to find your PAN number by name is through the NSDL (National Securities Depository Limited) portal. Here’s how:

-

Visit the NSDL PAN Portal: Go to the NSDL PAN website at https://www.tin-nsdl.com.

-

Select the PAN Option: Under the PAN section, select the option to know your PAN number.

-

Enter Your Details: Provide your full name, date of birth, and other required details as per the PAN records.

-

Submit and Verify: Submit the form and verify your identity through an OTP sent to your registered mobile number.

-

View Your PAN Number: After verification, your PAN number will be displayed on the screen.

3. Contact PAN Service Centers

If you prefer offline methods or encounter issues with the online portals, you can visit a PAN service center or TIN Facilitation Center. Here’s what you need to do:

-

Visit a PAN Service Center: Find your nearest PAN service center or TIN Facilitation Center. You can locate these centers through the Income Tax Department’s website.

-

Provide Your Details: Share your full name, date of birth, and father’s name with the officials at the center.

-

Retrieve Your PAN: The officials will assist you in retrieving your PAN number based on the details you provide.

4. Use the Aadhaar-PAN Link Method

If your PAN is linked with your Aadhaar number, you can retrieve your PAN number using your Aadhaar details. Here’s how:

-

Visit the UIDAI Website: Go to the official UIDAI website https://uidai.gov.in.

-

Check Aadhaar-PAN Link Status: Use the Aadhaar-PAN linking feature to check if your PAN is linked with your Aadhaar.

-

Retrieve PAN: If linked, your PAN number may be available through the Aadhaar services.

5. Email or Call the Income Tax Department

If online methods are not feasible for you, you can reach out to the Income Tax Department’s helpdesk via email or phone.

- Email: Send an email to ask@incometax.gov.in with your name, date of birth, and father’s name.

- Phone: Call the Income Tax helpline at 1800 180 1961 (Toll-Free).

Provide the required details, and the helpdesk will assist you in retrieving your PAN number.

Important Tips

- Ensure Correct Details: When using your name to retrieve your PAN number, make sure the details you enter match exactly with those on your PAN records.

- Keep a Copy of Your PAN: Once you retrieve your PAN number, save it in a secure location, both digitally and physically.

- Apply for a Duplicate PAN Card: If you’ve lost your PAN card, consider applying for a duplicate PAN card through the NSDL or UTIITSL portals.

Conclusion

Finding your PAN card number by name is a simple process if you follow the steps outlined above. Whether you use the Income Tax Department’s e-Filing portal, the NSDL site, or contact a PAN service center, you can quickly retrieve your PAN number and continue with your financial activities. Keep your PAN number safe and easily accessible to avoid any future inconveniences.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455). By giving your name, father's name, your Aadhaar card number details, the PAN card number on your name will be given. After taking the PAN number, apply in Pan CSF.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?