How to Apply for an NRI PAN Card: A Complete Guide

An NRI PAN (Permanent Account Number) application is essential for Non-Resident Indians (NRIs) engaging in financial transactions in India. NRIs require a PAN card for activities such as opening an NRO/NRE bank account, investing in Indian stocks, filing taxes, or buying property. The application process involves filling out Form 49A, submitting proof of identity (such as a passport), proof of address, and two passport-sized photographs. NRIs can apply online via the NSDL or UTIITSL portals. The PAN card enables smoother financial transactions and compliance with Indian tax laws for NRIs.

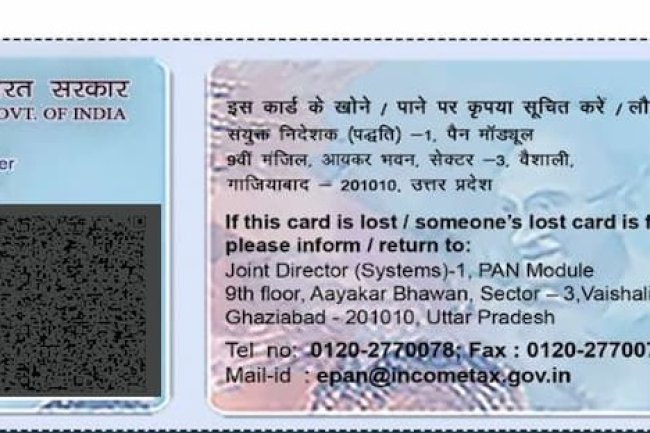

A PAN (Permanent Account Number) card is an essential identification tool for anyone engaging in financial transactions in India, including Non-Resident Indians (NRIs). Whether you're investing in the stock market, purchasing property, or conducting business, having a PAN card is mandatory for many activities. This guide will help NRIs understand the steps to apply for a PAN card, the documents needed, and other key details.

Why Do NRIs Need a PAN Card?

NRIs need a PAN card for various financial purposes, such as:

- Opening an NRO/NRE bank account.

- Filing income tax returns in India.

- Investing in Indian stock markets or mutual funds.

- Purchasing or selling property in India.

- Receiving payments or commissions from business activities in India.

Without a PAN card, many of these transactions are not possible, and tax rates on income might be higher for NRIs.

Step-by-Step Guide to Applying for an NRI PAN Card

-

Visit the NSDL or UTIITSL Website To apply for an NRI PAN card, you can go to the official websites of NSDL or UTIITSL, which handle PAN applications. NRIs must fill out Form 49A, specifically designed for Indian citizens and NRIs.

-

Choose the Appropriate Form Ensure you select Form 49A, which is applicable to NRIs, as Form 49AA is meant for foreign citizens.

-

Provide the Required Documents NRIs must submit the following documents for their PAN application:

- Proof of Identity: Passport, Aadhaar card, or OCI/PIO card.

- Proof of Address: Utility bills, foreign bank statements, or the passport’s address page.

- Passport-sized Photographs: Two recent color photos.

-

Fill in Your Details Complete Form 49A with your personal and contact information, including your foreign address. Make sure all details are accurate to avoid rejection of your application.

-

Submit Documents and Payment Submit your documents and make the required fee payment. If applying from outside India, additional courier charges might apply.

-

Track Your Application Once you’ve submitted the form and documents, you will receive an acknowledgment number. You can track your PAN application status using this number on the respective portal.

-

Receive Your PAN Card After approval, the PAN card will be sent to your registered address. For NRIs, this can be their foreign address if specified during the application process.

Important Tips for NRIs

- Ensure that the documents are self-attested before submission.

- NRIs living in countries like the U.S. or U.K. may need to provide additional supporting documents to prove foreign residence.

- Use a reliable courier service when sending physical copies of your documents, if required.

Conclusion

Applying for an NRI PAN card is a straightforward process if you have all the required documents and follow the application steps carefully. Having a PAN card not only simplifies financial transactions but also ensures compliance with Indian tax laws.

If you want to apply PAN card, apply through this link https://idserve.in/

What's Your Reaction?