How to Apply for a PAN Card for NRIs Online: Step-by-Step Guide

How to Apply for a PAN Card for NRIs Online: A Quick Guide Non-Resident Indians (NRIs) can easily apply for a PAN card online for financial transactions, tax filing, and investments in India. To apply, visit the official NSDL or UTIITSL website and fill out Form 49AA. Submit the required documents, including proof of identity (passport), proof of address (overseas address), and passport-sized photographs. Pay the application fee online and submit the form. Once submitted, you’ll receive an acknowledgment number to track the status. The PAN card will be sent to the address provided, whether in India or abroad, and the process typically takes 15-20 business days.

Introduction:

Non-Resident Indians (NRIs) often need a Permanent Account Number (PAN) card for financial transactions in India. Whether it’s for filing income tax returns, investing in stocks or mutual funds, or buying property, a PAN card is essential. Fortunately, NRIs can easily apply for a PAN card online from anywhere in the world. This article will walk you through the step-by-step process of applying for a PAN card online as an NRI, the required documents, and other key details to make the process smooth and hassle-free.

Why NRIs Need a PAN Card?

As an NRI, you may need a PAN card for the following reasons:

- Filing income tax returns in India

- Investing in the Indian stock market, mutual funds, or other financial instruments

- Purchasing or selling property in India

- Opening a bank account or a Demat account in India

- Conducting high-value financial transactions

How to Apply for a PAN Card Online as an NRI

NRIs can apply for a PAN card online via two official websites:

- NSDL (National Securities Depository Limited) - https://www.tin-nsdl.com

- UTIITSL (UTI Infrastructure Technology and Services Limited) - https://www.utiitsl.com

Here’s a step-by-step guide to applying for a PAN card online as an NRI:

Step 1: Visit the Official Website

- Go to the NSDL or UTIITSL website, and select the option for New PAN Card (Form 49A) application for NRIs.

Step 2: Select the Appropriate Form

- NRIs need to fill out Form 49A for PAN card applications. The form is available online on both websites.

Step 3: Fill Out the Online Application Form

- Complete the online application form by entering your personal details such as name, date of birth, overseas address, contact details, and nationality.

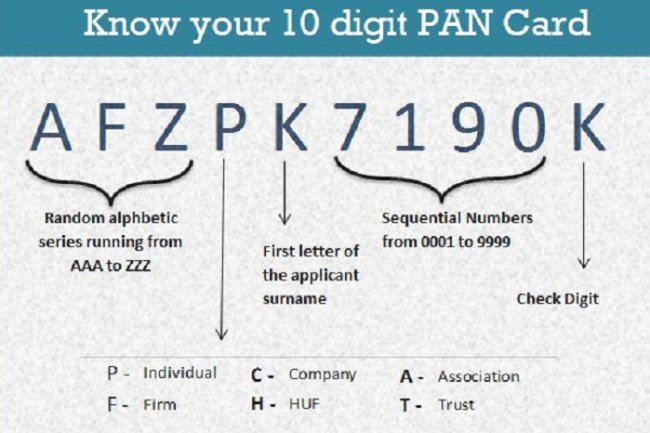

- Select the appropriate category (Individual, Association of Persons, Trust, etc.)

Step 4: Submit Required Documents

You’ll need to upload scanned copies of the following documents:

- Proof of Identity: Passport, Overseas Citizen of India (OCI) card, or Person of Indian Origin (PIO) card

- Proof of Address: Foreign address proof (such as bank statement, utility bill, or lease agreement)

- Photographs: Two recent passport-sized photographs

Step 5: Pay the Application Fee

- The application fee varies depending on whether the PAN card will be sent to an Indian or overseas address. NRIs can pay the fee online using credit/debit cards or via net banking. A payment gateway will appear during the submission process.

Step 6: Submit the Application

- After filling in all the details and uploading the documents, submit your application online.

- Upon successful submission, you will receive an acknowledgment receipt with a unique 15-digit acknowledgment number. This number can be used to track your application status.

Important Points to Note:

- Ensure that all details entered are accurate to avoid delays or rejection of the application.

- The PAN card will be sent to the address mentioned in the application (in India or overseas).

- The processing time for online PAN card applications for NRIs is usually 15-20 business days.

Documents Required for NRIs to Apply for PAN Card Online:

- Proof of Identity: Passport, OCI/PIO card

- Proof of Address: Overseas address proof (bank statement, utility bill, etc.)

- Photographs: Two recent passport-sized photos

Benefits of Applying for a PAN Card Online:

- Convenience: Apply from anywhere in the world, 24/7.

- Faster Processing: Online applications tend to be processed quicker than physical applications.

- Secure Payment: Application fees can be paid online securely through multiple payment options.

Conclusion:

Applying for a PAN card online as an NRI is a simple and convenient process. By following the steps outlined in this guide and ensuring that you have all the necessary documents ready, you can easily complete your PAN card application without having to visit India. Whether you’re investing in India or need to manage taxes, a PAN card is vital for NRIs, and the online application makes it accessible no matter where you are.

If you want to apply NRI PAN card, apply through this link https://idserve.in/

What's Your Reaction?